FILS in Barcelona: What blockchain can do for bond markets

What progress is being made in the world of blockchain, and how is DLT technology transforming the world of digital bonds, crypto trading, and...

BondWave reports volume/liquidity paradox

Trading efficiency has driven down the costs of trading, and supported the ability to find liquidity, despite falling volumes, says BondWave’s Paul Daley, MD...

Industry viewpoint: How to build a better picture of the global fixed income markets

Guido Galassi, Head of Data & Cash Product, MTS

In volatile market conditions, more accessible and meaningful data has become critical to navigating the path...

Portfolio trading on the up: fixed income electronifies and sell-side sentiment down, says valantic/Acuiti

Sell-side fixed income participants are witnessing the deepening electronification of fixed income markets, according to a report from Acuiti in association with valantic FSA.

As...

‘Tis better to give than to receive? How ELPs affect credit trading

In a Christmassy spirited theme, The DESK considers how the advantages of electronic liquidity provision can support credit markets – and how the reception...

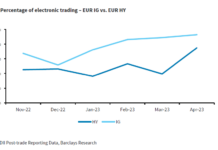

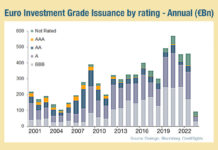

Europe’s record IG credit issuance could boost electronic trading

January was a record month for investment grade bond issuance in Europe, with shorter-dated driving this activity. According to analyst firm CreditSights, shorter maturity...

Karen Karniol-Tambour named co-chief investment officer at Bridgewater

Nir Bar Dea, co-chief executive officer at Bridgewater has confirmed that Karen Karniol-Tambour is now co-chief investment officer of the firm, joining Bob Prince...

End to End CSDR Processing – Roles, Responsibilities, and Issues for all Participants

On 22nd July, 2020 a panel of market participants discussed the detailed implications of the Central Securities Depository Regulation (CSDR).

The panel comprised, J.R. Bogan,...

CME Group launches price comparison tool for cash US Treasuries and futures

Derivatives market operator, CME Group, has launched UST Market Profile, a tool to bring together listed Treasury futures and BrokerTec cash treasuries in one...

MarketAxess reports record electronic trading volumes for January

By Flora McFarlane.

MarketAxess, electronic trading platform for fixed income securities, has reported that January was a record month for daily and monthly trading volumes,...

Coalition Greenwich: Regulation and macro concerns dominate for derivatives users

A new report, ‘Derivatives Market Structure 2024: Focusing on Capital and Workflow Efficiency’, has found that 58% percent of end users of derivatives, and...

Natwest Markets trading desk automating fixed income trading workflow with ipushpull

Natwest Markets has implemented a new PPQ (Pushpull Quotes) workflow system to streamline manual workflow around non-standard, complex trades such as fixed income trading.

Matthew...