Tag: CME

CME Group set to clear US cash Treasuries

A CME Group representative has confirmed to The DESK that the company is set to enter US Treasury clearing.

The news was first reported...

November’s bumper month for fixed income e-trading

Electronic trading platforms have reported a bumper November for fixed income trading, with CME reporting interest rate average daily volume (ADV) up by 42%;...

FILS in Barcelona: If the future is futures, what happens when...

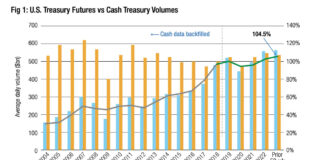

Moving liquidity from the spot or cash markets into futures is raising some concern amongst market participants. In FX, trading volume on the Thomson...

Beyond Liquidity: Regulators warn on alternative Libor rates

Libor, the benchmark interest rate that was embedded in hundreds of trillions of dollars of financial contracts around the world, ceased publication at the...

Lower market volumes hitting platforms hard in June

Electronic platforms saw tough market conditions hitting volumes, reflecting lower trading volatility overall in the market, although Tradeweb was able to post net average...

FILS USA 2023: Market volatility has tested e-trading and instrument selection

Having had a challenging and volatile first half of the year from a liquidity perspective, not least because of a crisis in US and...

Mixed trading volumes in May for fixed income across platforms

Looking at the numbers from the major trading platforms in May, volumes appear to be recovering which will be positive for dealers, who saw...

When banks go bust holding boring bonds

**This article will appear in full in the next issue of The DESK**

Government bonds are described as a 'risk-free' instrument, on the basis that...

Exclusive: David Nicol leaves LedgerEdge; Rutter steps forward in interim

David Nicol, co-founder of LedgerEdge, a distributed ledger-based fixed income trading venue, has left his position as CEO. Ian Chicken, chief operating officer at...

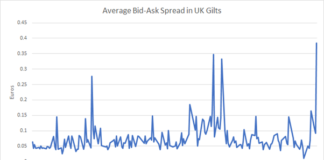

In pictures: Government bond market liquidity costs spike

Both volume and bid-ask spreads have blown out in the UK government bond (Gilt) market, as seen in the latest TraX data from MarketAxess, which...