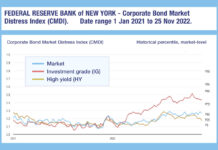

Substantially higher US investment grade stress going into 2023

The Federal Reserve Bank of New York’s Corporate Bond Market Distress Index (CMDI) is closing 2022 with investment grade US bond markets twice as distressed as...

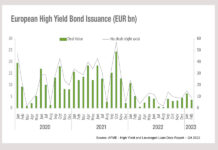

Rising rates hit high yield availability

Despite some optimistic outlooks on bond issuance in 2023, high yield bonds are clearly seeing a decline in Europe, based on data from the...

Germany’s rates market comfort

Germany’s government bond market is in rude health, according to the latest analysis of sovereign debt by Andy Hill, director at the International Capital...

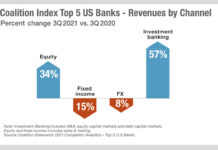

What banks’ primary success can tell us about their priorities in 2022

When looking at the revenues of investment banks in Q3 2021, using Greenwich Coalition data, we can see that secondary market trading in fixed...

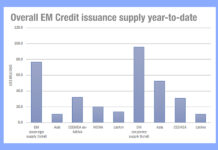

Issuance and inflows paint more positive picture for EM liquidity

Over the past week emerging markets (EM) credit issuance saw US$7.6 billion in newly issued bonds, against US£900k the week before, while on the...

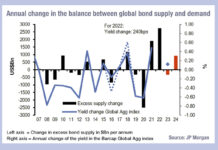

Rising rates but falling demand

Analysis by JP Morgan’s Global Markets Strategy team, Nikos Panigirtzoglou, Mika Inkinen and Mayur Yeole has cast an interesting light on the prospects for...

2022: Big primary, smaller secondary?

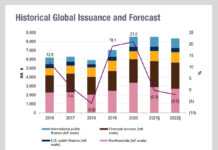

Despite the expectation of rising rates across markets, S&P Global Ratings Research are predicting that issuance of new bonds across markets will not see...

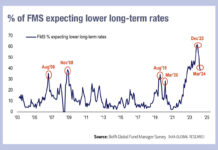

Great Expectations (on rate cuts)

The latest BofA Global Fund Manager Survey has found that 76% of respondents expect two or more Fed cuts in 2024 versus 8% who...

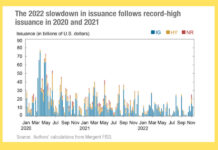

Liberty Street Economics asks: How Is the corporate bond market functioning as rates rise?

The Federal Reserve Bank of New York’s market structure and macro analysts, Liberty Street economics, has examined how corporate bond market functioning has withstood...

Can primary markets deflate?

Inflation levels could have a direct impact on volume of work – and therefore operational pressure – on buy-side trading desks.

Managing the process of...