The liquidity gap between 144A and Reg S bonds

144A and Regulation S (Reg S) securities have distinct regulatory backgrounds and key differences. Liquidity measures such as Bid-Ask spread and post-issuance volumes in...

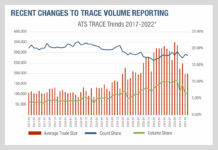

What FINRA’s trade reporting changes tell us about consolidated tapes

Understanding the difference between commercial and public data offerings is crucial for data users. A good example of this difference can be found with...

Prioritising investment on the high yield trading desk

When we look at the priorities of trading desks in developing more automated tools, we can consider the longer term market trends as a...

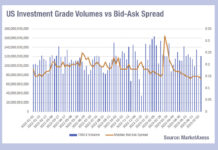

Implied cost of liquidity falling, with US high yield an exception

Volumes in the corporate bond markets have been picking back up, relative to bid-ask spreads, indicating an improving liquidity picture across the US and...

US Credit: Liquidity costs trending down

The bid-ask spread in US high yield trading is falling again having suffered an uptick in December, according to MarketAxess Trax, which tracks trading...

Emerging markets’ big issues in 2022

According to analysis by CreditSights, there has been a negative total return for credit in emerging markets with the exception of Gulf Cooperation Council...

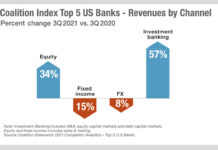

What banks’ primary success can tell us about their priorities in 2022

When looking at the revenues of investment banks in Q3 2021, using Greenwich Coalition data, we can see that secondary market trading in fixed...

Credit Indices – Closing the Fixed Income Evolutionary Gap

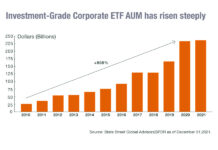

Fixed income markets are evolving at pace, with smarter electronic trading protocols, more sophisticated, automated investment strategies and a greater availability of useful data.

In...

A surfeit of bonds?

Henry I of England famously died from eating a surfeit of lampreys – a delicacy until consumed to excess. Central banks might want to...

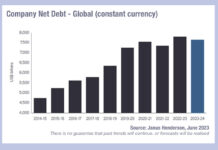

Issuance pushes outstanding global debt up 6.2%

Companies around the world took on US$456 billion of net new debt in 2022/23, as of 31 March 2023, pushing the outstanding total up...