The changing liquidity picture for fallen angels and rising stars

When a company has its credit rating adjusted, the impact on bond liquidity is not entirely predictable. In a changeable rate environment as seen...

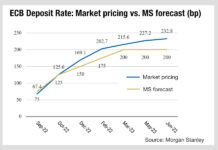

Chart of the week: ECB rates rise expectations

Expectations on the European Central Bank’s appetite to increase its interest rate will have a direct and negative impact on European bond trading which...

Bank of England releases detail on index-linked gilt purchases as LDI woes continue

The Bank of England (BoE) has said it continues to monitor developments in financial markets very closely in light of the significant asset repricing...

Sterling dealers recommend SONIA as alternative to LIBOR

The Bank of England’s Working Group on Sterling Risk-Free Reference Rates – a group of major dealers active in sterling interest rate swap markets – has...

How Fed bond buying is impacting markets

The Federal Reserve Bank of New York is hoovering up assets in order to support corporate borrowing in the US, and subsequently creating some...

The Fed and BlackRock’s bond-buying criteria challenged

Detail around the Primary Market Corporate Credit Facility (PMCCF) and Secondary Market Corporate Credit Facility (SMCCF) launched by the Federal Reserve Bank of New...

CME Group: Expectation of rates rises for BoE in December 2021 and Fed in...

The CME Group’s central bank observations tools BoEWatch and FedWatch show that market expectations indicate increasing probability of a Bank of England rate rise...

Liberty Street Economics: Active trading could drive loan standardisation

By Flora McFarlane.

A Liberty Street Economics report analysing the US secondary loan market has found that increased trading and liquidity will potentially standardise loans.

The...

New York Fed economists see US Treasury liquidity at crisis levels

Current US Treasury market liquidity is comparable with the 2007-09 global financial crisis and the March 2020 crisis, particularly for the two-year note, according...

On The DESK : Alex Brause : The central bank’s buy-side trader

Balancing leadership and discipline with greater autonomy in trading. Alexander Brause speaks to The DESK and explains his role as head of fixed income...