Dan Barnes

Editorial Director

Latest From Dan Barnes

Direct streaming builds support at TradeTech

The evolution of bond trading, through the smart application of technology and increasingly sophisticated market making is promising to deliver better execution, said Lynn Challenger, global head of trading and order generation at UBS Asset Manage...

Read more

Neil Palan joins Sarasin & Partners

Neil Palan has joined Sarasin & Partners, an investment manager with £18.8 billion in assets under management, as a multi-asset trader. Palan spent 16 years at Odey Asset Management, most recently as a trader and head of treasury, before the f...

Read more

The credit trading processes you really should have automated by now…

Automation has historically been highly challenging in corporate bond markets for several reasons, but traders say some parts of the workflow ‘ought’ to be automated by now within buy-side firms. There are markets in which trading is so automate...

Read more

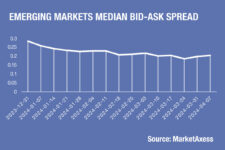

Bid-ask spreads drop 25% on average in many markets

The cost of liquidity as measured by the bid-ask spread in bond trading has fallen by approximately 25% since the start of the year, according to data from MarketAxess’s CP+ pricing service. In real terms, the drops reflect falls of nearly ten b...

Read more

Great Expectations (on rate cuts)

The latest BofA Global Fund Manager Survey has found that 76% of respondents expect two or more Fed cuts in 2024 versus 8% who expect to see no cuts. That said, but investors are reportedly less optimistic on inflation and bonds than they were ...

Read more

Jupiter AM: Training to trade against heavyweight rivals in fixed income

Jupiter Asset Management has trained its trading team on data and analytics in order to beat its rivals to the punch when finding liquidity and pricing in fixed income. Alison Hollingshead, chief operating officer (COO), and Mike Poole, head...

Read more

Jefferies moves into outsourced fixed income trading with Siegel hire

Industry veteran Jory Siegel has joined Jefferies as head of fixed income outsourced trading, from Marex. Siegel was previously managing director and head of fixed income outsourced trading at TD Cowen, which was bough by Marex. He has over...

Read more

Equity venues are dating websites; credit venues are bars

Equity venues are dating apps – you have to be a member to use the central limit order book (CLOB), and it will match you up with a counterpart based on its rules. In corporate bond markets, venues are bars – you can meet counterparts there, but...

Read more