This page is dedicated to research articles with secondary market data provided by MarketAxess. For further information please contact Dan Barnes.

Home ‘BoB’ – Barnes on Bonds

‘BoB’ – Barnes on Bonds

SECONDARY MARKETS

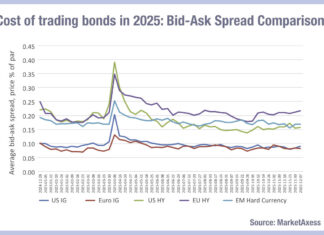

Bid-ask spread volatility highest in US bond markets

When comparing liquidity across markets in 2025, buy-side bond traders may consider European investment grade markets to have an optimal set of characteristics. However, that warrants deeper analysis.

Looking at MarketAxess data from its TraX...

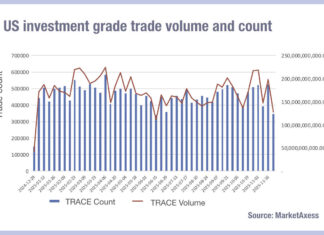

US credit activity dropped off a cliff in late November

Analysis of US corporate bond market activity has found that trading volumes and counts plummeted going into the final month of the year. A fall at year-end is not unexpected due to a combination...

PRIMARY MARKETS

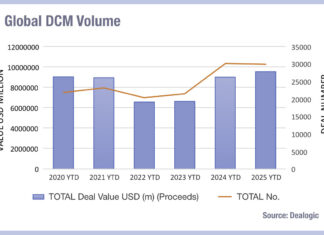

Dealogic: DCM deals in 2025 up 18% on five-year average

The preliminary view of 2025 capital markets deals, published by Dealogic, has found that global DCM volume delivered a total of US$9.5 trillion, 19% higher than the previous five-year average. There were nearly 30,000...

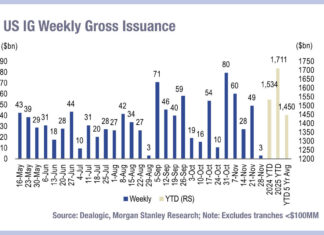

IG issuance across US and Europe up 20% on five-year average

US investment grade debt issuance has hit $1.7 trillion year to date (YTD) in 2025, a 12% increase year on year (YoY). That brings outstanding IG US debt to US$9.5 trillion, and 2025 now...