MARKET NEWS

US Treasury e-trading declined in 2025

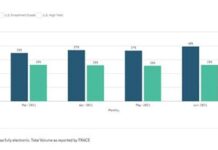

Electronic trading of US Treasuries declined in 2025 despite rising average daily notional volumes (ADNV), according to a Coalition Greenwich report.

ADNV was up 16%...

Scott joins Aware Super

Andrew Scott has joined Aware Super as a senior fixed income portfolio manager. He is based in Sydney.

Aware Super holds AUD 200 billion in...

ICE posts challenge to FICC with Treasury clearing

The Intercontinental Exchange’s (ICE) Clear Credit platform is now clearing US Treasuries, following approval from the US Securities and Exchange Commission.

Treasury repos are expected...

Casa de Bolsa Finamex recruits Rábago

Eduardo Aguilar Rábago has joined the institutional fixed income sales team at Mexican brokerage Casa de Bolsa Finamex.

He is based in Mexico City.

Casa de...

BondAuction completes inaugural trade

BondAuction has completed its first trade, a retained-bond sale by UK affordable housing aggregator Housing Finance Corporation.

The corporation announced its partnership with BondAuction in...

UK CTP will cost pennies – support will cost thousands

Out-of-hours support will cost more than access to bond consolidated tape data under Etrading Software’s pricing and licensing framework.

The maximum cost for a combined...

FEATURES

Human battles machine in JGB market

Participants say electronic trading of Japanese government bonds has reached an inflection point, but others counter that the death of voice trading has been...

Credit futures see OI and ADV increase more than sevenfold YoY

The adoption of credit futures as a mainstream credit trading vehicle is broadening across venues and currencies: US$ iBoxx total return based futures traded...

Trade size growth undercuts European bond market ‘equitification’

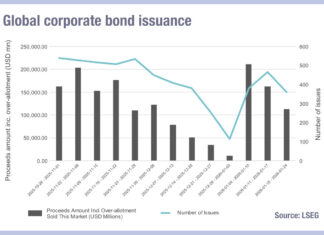

Since 2023 European corporate bond markets have seen trades size grow, as trading platforms report increasing volumes

“If we break down electronic trading growth in European...

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

PROFILES

RESEARCH

Bond traders predict data science/AI use explosion in 2026

The DESK’s Corporate Bond Liquidity Access Survey, supported by LTX, finds trading desks are on the cusp of change.

Buy-side traders see 2026 as a turning...

Subscriber

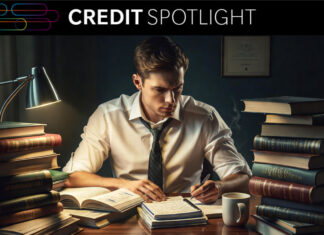

Credit Spotlight

FROM THE ARCHIVES

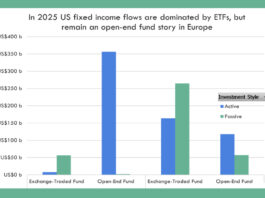

Evidence of trading efficiency from electronification

This week we look at the growth of electronic trading in the US fixed income markets, and the potential it holds to reduce time...

Origination: S&P prices major senior note issuance

S&P Global has priced a total US$10 billion in senior notes.

The offering is split into US$600 million 4.250% senior notes due 15 January 2031,...

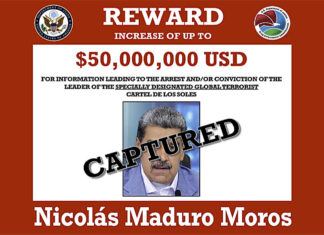

Rules & Ratings: EM credit risk on the rise, says Fitch

Fitch Ratings has revised its sector outlooks for APAC, Eastern Europe and Sub-Saharan Africa sovereign to ‘deteriorating’ from ‘neutral’ as credit risk rises.

Credit risk...

Tharshan joins Citi credit trading team

Tharsh Tharshan has joined Citi as a credit trader. He is based in London.

Citi reported revenues of US$81.1 billion in 2024, up 3% from...

Erik Swords to head AllianzGI’s technology investment team

Allianz Global Investors (AllianzGI), has published succession plans for its global technology investment team, which has been led by Walter Price since inception.

After more...

Technology: The real reason you cannot get a new trading system

Lynn Strongin Dodds investigates the barriers to adopting new technology.

Technological advances may be developing at breakneck speed but many of the barriers of adoption...

Bank of England launches SWES test for bond markets

The Bank of England (BoE) has published the latest phase of the System-wide Exploratory Scenario (SWES) with bank and non-bank participants provided a hypothetical...

MiFID II: What could go wrong

Keep an eye on these potential points of failure, writes Dan Barnes.

For trading desks the impact of the new Markets in Financial Instruments Directive...

Amber Wright picks up EMEA sales role at RJ O’Brien

Futures brokerage and clearing firm RJ O’Brien has appointed Amber Wright as head of EMEA sales. She takes on the role in addition to...

Eurex meets credit index futures demand with new products

Eurex has launched Bloomberg US Corporate Index Futures and Bloomberg US High Yield Very Liquid Index Futures, building out its global credit index futures...

Trumid zeroes in on data automation, appoints Ryan Gwin

Trumid has expanded its data and intelligence and automation divisions, appointing Ryan Gwin as head of data solutions. The divisions were established four years...

More EM platform consolidation amid liquidity challenges

Emerging markets have offered a strong opportunity for yield in recent years, albeit with greater credit risk and FX volatility, however getting access to markets...