No Danish Compromise for BNP Paribas

BNP Paribas has finalised its acquisition of AXA Investment Managers (AXA IM) and clarified its leadership structure going forward.

The firm has not been able...

Propellant prepares for CT with data streaming expansion

Propellant Digital has introduced FIX data streaming on its platform, developing a framework allowing clients to access aggregated post-trade transparency data in advance of...

Octaura and Allvue push ahead on loan market electronification

Octaura and Allvue have partnered to boost electronic trading in loan markets, combining their solutions for alternative asset manager ICG.

Octaura, which provides electronic trading,...

Two thirds of bond issuers meet 2025 targets by June

Issuers are meeting their targets early this year as they get used to unpredictable markets, according to Mike Koerkemeier, global head of capital markets at...

RBC joins ICE Clear Credit

RBC Capital Markets has joined Intercontinental Exchange (ICE) Clear Credit as a futures commission merchant (FCM). RBC becomes the first FCM participant at ICE...

Tradeweb offers corporate treasurers US T-bill trading

Corporate treasurers can now directly trade US Treasury bills (T-bills) through Tradeweb’s electronic trading platform.

The announcement follows Tradeweb’s 2024 acquisition of Institutional Cash Distributors...

Jeddy Lee promoted at ZCG

Z Capital Group (ZCG) has promoted Jeddy Lee to managing director and head of credit as it continues to expand its credit platform.

In the...

SEC pushes back “unreasonable” broker-dealer compliance deadline

The Securities and Exchange Commission (SEC) has pushed back the compliance date for amendments to its broker-dealer customer protection rule (15c3-3).

The amendments will now...

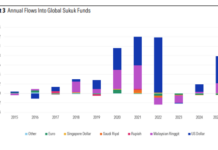

Morningstar: Sukuk market grows despite liquidity and concentration risk

According to Morningstar, at the end of 2024, the global sukuk markets, which represents Islamic securities structured to replicate conventional bonds, reached US$930 billion...

ESMA’s DLT regime could go permanent, despite low takeup

The European Securities and Markets Association (ESMA) has outlined potential amendments to make its distributed ledger technology (DLT) pilot regime permanent, despite a lacklustre...