This page is dedicated to research articles with secondary market data provided by our research partner MarketAxess. For further information please contact Dan Barnes.

Home ‘BoB’ – Barnes on Bonds

‘BoB’ – Barnes on Bonds

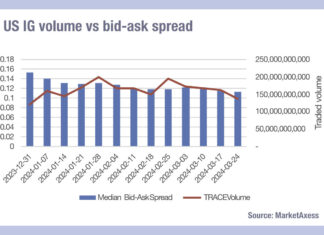

Bid-ask spreads drop 25% on average in many markets

The cost of liquidity as measured by the bid-ask spread in bond trading has fallen by approximately 25% since the start of the year, according to data from MarketAxess’s CP+ pricing service.

In real...

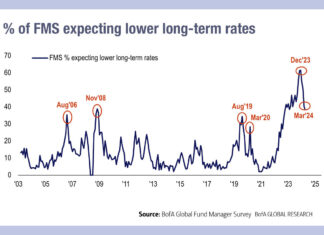

Great Expectations (on rate cuts)

The latest BofA Global Fund Manager Survey has found that 76% of respondents expect two or more Fed cuts in 2024 versus 8% who expect to see no cuts.

That said, but investors are reportedly...

MarketAxess industry viewpoint

Comparing portfolio trading and list RFQ TCA

By Gio Accurso, Grant Lowensohn and Jessica Hung, MarketAxess

Highlights and objectives

The MarketAxess Research team investigates any key drivers of Portfolio Trading (PT) Trading Cost Analysis (TCA) outcomes,...

High yield bond issuance relative to liquidity

A report by the Association for Financial Markets in Europe (AFME) has found that primary issuance of European high yield (HY) bonds in 2023 reached a value of €66 billion on 185 deals, which...

Volumes drop off as Q1 ends, but liquidity still cheap

A broad decline of trading volumes across European & US corporate bond and emerging market debt trading coincided with end of the first quarter of the year, according to data from MarketAxess’s TraX, which...

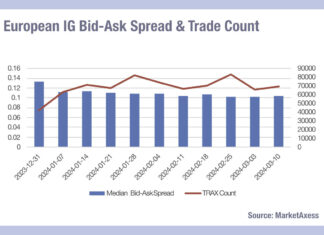

European investment grade seeing smaller, cheaper trades

European investment grade bond traders are seeing a falling bid-ask spread, and a rising trade count since the start of 2024, according to MarketAxess’s CP+ and TraX, which follows activity across multiple markets.

This points...

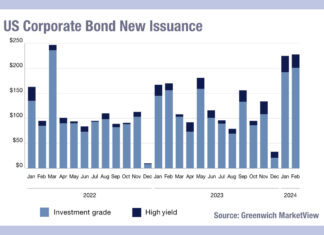

Issuing at the top of the market

The high levels of bond issuance this year, made at what is widely expected to be peak interest rates, are potentially building up high levels of credit risk for issuers.

Although issuance has been focused...

AFME and IA agree on UK consolidated bond tape

The Association for Financial Markets in Europe (AFME) has reached an agreement with the Investment Association (IA) on a proposal for a future UK post-trade transparency model for corporate and sovereign bonds.

The framework...

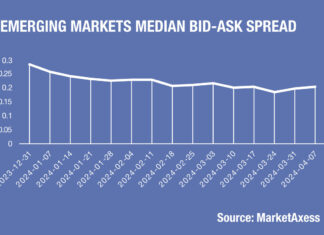

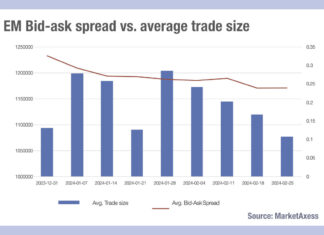

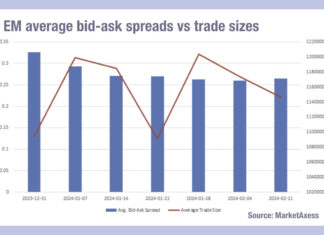

What is driving down EM trading costs?

Analysis of trade size and bid-ask spread data from MarketAxess’s CP+ pricing feed and Trax market data, which tracks activity across markets, indicates that since the end of January, average trade sizes and bid-ask...

Germany’s rates market comfort

Germany’s government bond market is in rude health, according to the latest analysis of sovereign debt by Andy Hill, director at the International Capital Markets Association (ICMA), despite having the loosest primary market obligations...

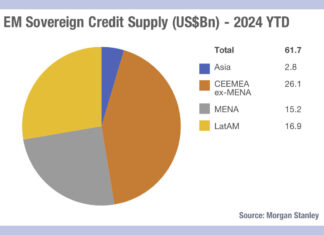

Morgan Stanley: EM issuance in 2024 to outstrip 2023

Assessment from Morgan Stanley has found sovereign hard currency gross issuance is likely to increase to US$164 billion in 2024 due to more open market access.

Last year hard currency bond issuance in European and...

Emerging markets trading costs threaten to rise

Emerging market bond traders will see trading costs rising as volumes begin to decline. According to MarketAxess data from its CP+ pricing tool and the Trax service, which assesses trading activity across multiple markets...