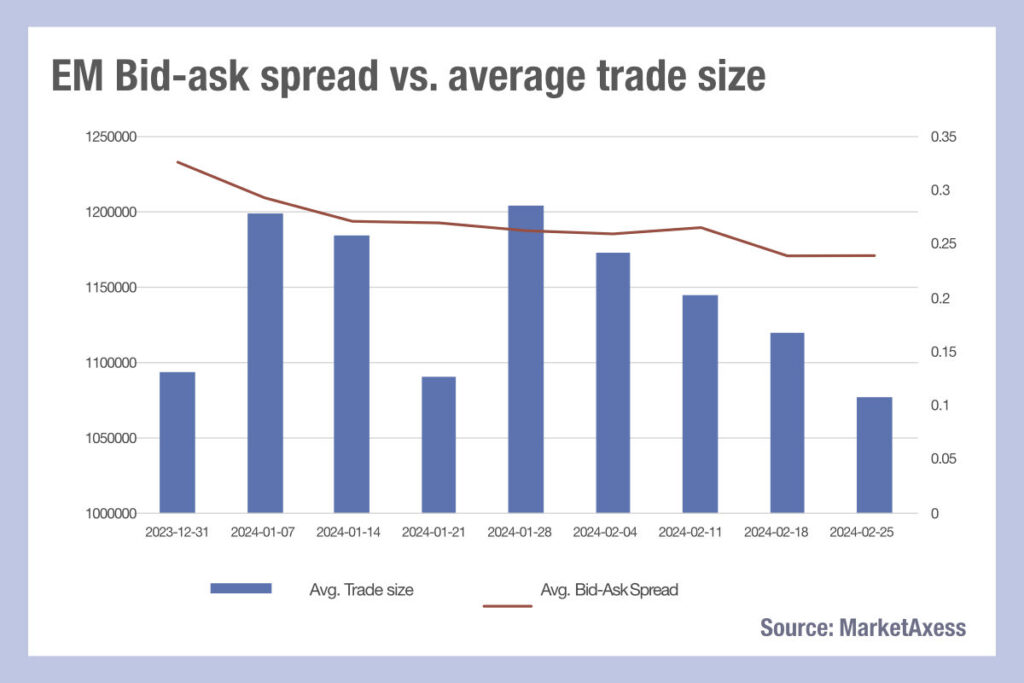

Analysis of trade size and bid-ask spread data from MarketAxess’s CP+ pricing feed and Trax market data, which tracks activity across markets, indicates that since the end of January, average trade sizes and bid-ask spreads in emerging market bonds have both fallen.

The combination of falling average trade sizes and trading costs are typically seen in markets that are becoming heavily electronified. Smaller trade sizes can also be indicative of firms using smaller trades to test market liquidity before trading in larger size, which could be allowing blocks to trade at tighter bid ask spreads. However, falling levels across both metrics is indicative of a changing situation.

One possibility is that a virtuous circle is in play reflecting a directional move in the market. Given the disparate nature of the different markets that constitute EM debt as an asset class, it is challenging to identify a single market structural change that is occurring across the sector.

One proposed possibility is that EM funds are managing outflows, which they need to tackle with minimal cost impact, and with portfolio managers being unable to provide much support due to the pressure they are under to try and both stem outflows and even encourage inflows. Under this hypothesis, traders are trading odd-lots and trying to find relative-value trades in order to support the portfolio, which is leading to smaller trade sizes. These are more easily pushed out via electronic channels which is tightening bid-ask spreads.

Another possible effect is the growth of request-for-market (RFM) trades, which mask the direction of the buy-side position and therefore protect the sell-side firm that takes the other side to the trade. As dealers are able to trade out of their positions more effectively, they are able to tighten the spreads on offer to their clients.

©Markets Media Europe 2024

©Markets Media Europe 2025