MARKET NEWS

Boltzbit and Glimpse partner to deliver AI insights to bond traders

Glimpse Markets, a buy-side data-sharing platform for global cash bonds, is partnering with AI firm Boltzbit on a multi-phase integration that will add AI...

Hickling joins BNP Paribas

James Hickling has joined BNP Paribas as a rates repo trader.

In Q3 2025, BNP Paribas reported €1.3 billion in FICC revenues within the corporate...

NYSE looks to launch tokenised securities venue

The New York Stock Exchange (NYSE) is seeking regulatory approval for a tokenised securities platform and a new trading venue as parent company Intercontinental...

Chowdhury promoted at MarketAxess

Riad Chowdhury has been promoted to head of EMEA and APAC sales at MarketAxess.

Based in Singapore, he will retain his existing responsibilities as head...

Japanese bond vigilantes have a JGB one-way bet

Front-month ten-year Japanese Government Bonds (JGBs) futures are down 7% since early 2025 as volumes spike on down days, while the 10-year yield has...

Roupie joins Marex

Christophe Roupie has resurfaced at Marex, joining the firm as global head of electronic trading and platforms.

In October 2025, the firm expanded its fixed...

FEATURES

Human battles machine in JGB market

Participants say electronic trading of Japanese government bonds has reached an inflection point, but others counter that the death of voice trading has been...

Credit futures see OI and ADV increase more than sevenfold YoY

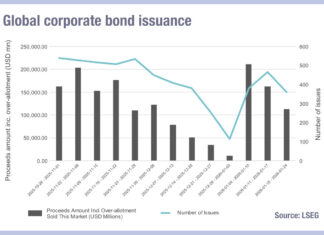

The adoption of credit futures as a mainstream credit trading vehicle is broadening across venues and currencies: US$ iBoxx total return based futures traded...

Trade size growth undercuts European bond market ‘equitification’

Since 2023 European corporate bond markets have seen trades size grow, as trading platforms report increasing volumes

“If we break down electronic trading growth in European...

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

PROFILES

RESEARCH

Bond traders predict data science/AI use explosion in 2026

The DESK’s Corporate Bond Liquidity Access Survey, supported by LTX, finds trading desks are on the cusp of change.

Buy-side traders see 2026 as a turning...

Subscriber

Credit Spotlight

FROM THE ARCHIVES

ESMA dials up bond CTP selection

ESMA has told several Bond CTP providers hopefuls that they have been invited to participate in the second step of competitive procedure with negotiation.

The...

State Street and FactSet partner to support better data management

State Street and FactSet have partnered to integrate State Street Alpha and FactSet to support streamlining of data flows across the front, middle and...

EXCLUSIVE: Citadel Securities confirms plans to enter corporate bond market

Citadel Securities has announced plans to enter the corporate bond market this year, The DESK can reveal, in a surprise play for one of...

Missing liquidity – Zen and the art of liquidity maintenance

Regulators cannot find the liquidity problem that traders see daily, threatening to set rules for game ‘A’, when game ‘B’ is played out in the markets. Chris...

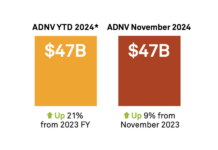

US corporate bond market continues upward trajectory

Average daily notional volumes (ADNV) were up 9% year-on-year (YoY) in US credit markets, reaching US$47 billion. Year-to-date, ADNV is up 21%.

In 2024, the...

SEC fines Bloomberg US$5 million for failure to disclose single quotes as BVAL source

Market operator and data provider, Bloomberg, has been fined US$5 million by US market regulator the Securities and Exchange Commission (SEC) for failing to...

Groupama Asset Management and Amundi Intermediation merge desks

Groupama Asset Management has partnered with Amundi Intermediation, merging the two trading desks to support the development of its execution business.

The decision has been...

US electronic credit trading slows down in May

Average daily TRACE volume for US investment grade (IG) and high yield (HY) corporates slipped 10.8% from April to US$52.8 billion, according to MarketAxess...

Amundi US and Victory Capital to merge in new 15-year partnership

European asset manager Amundi is set to become a strategic shareholder in global asset management firm Victory Capital, following a signed Memorandum of Understanding...

What the regulators don’t know about spoofing

At least 5% of treasuries volume is self-trading yet the legality of these trades is unchecked. Dan Barnes, reports.

Self-trading is defined as a transaction in...

BayernInvest taps Bloomberg for integrated asset management workflow offering

BayernInvest, a German asset manager with approximately €88 billion assets under control, has adopted an integrated suite of Bloomberg solutions to support its front-to-back...

Eurex: OTC interest rate derivatives markets

Eurex Clearing OTC IRD momentum grows, with new participants and new currencies

In this article, Eurex Clearing’s Danny Chart, Global Product Lead for OTC Interest...