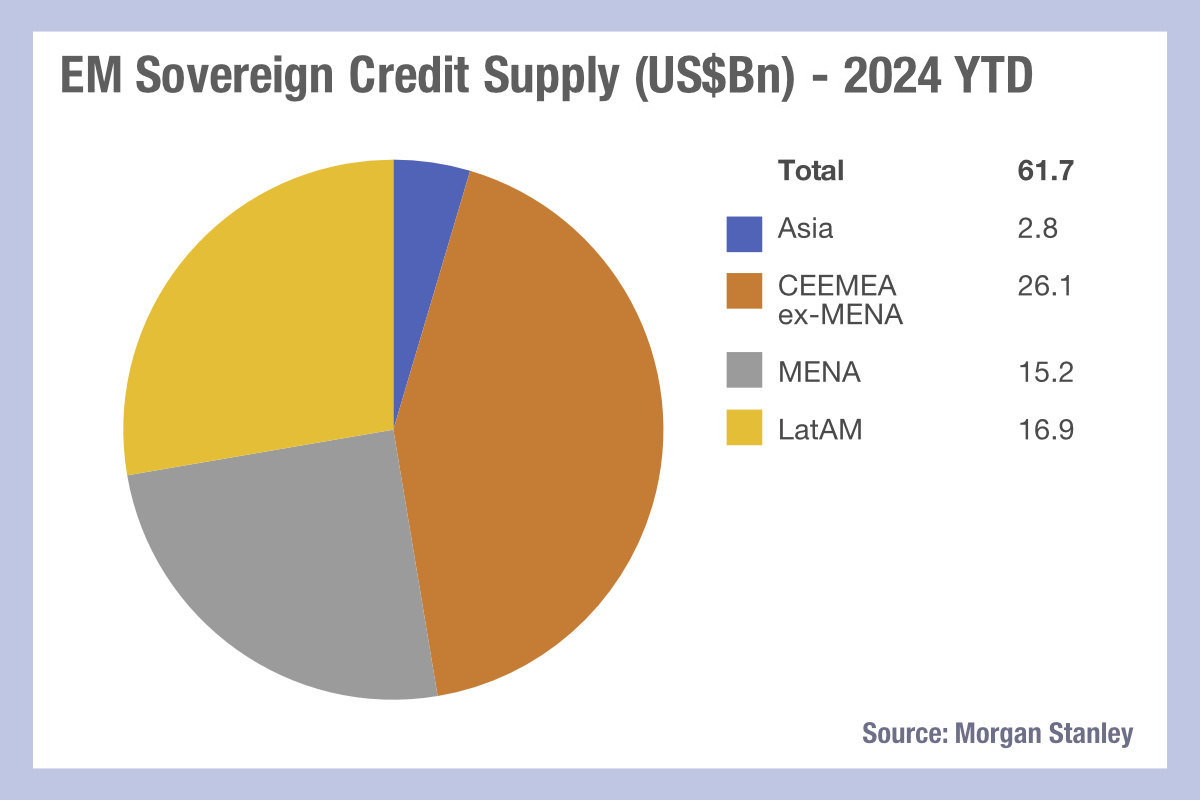

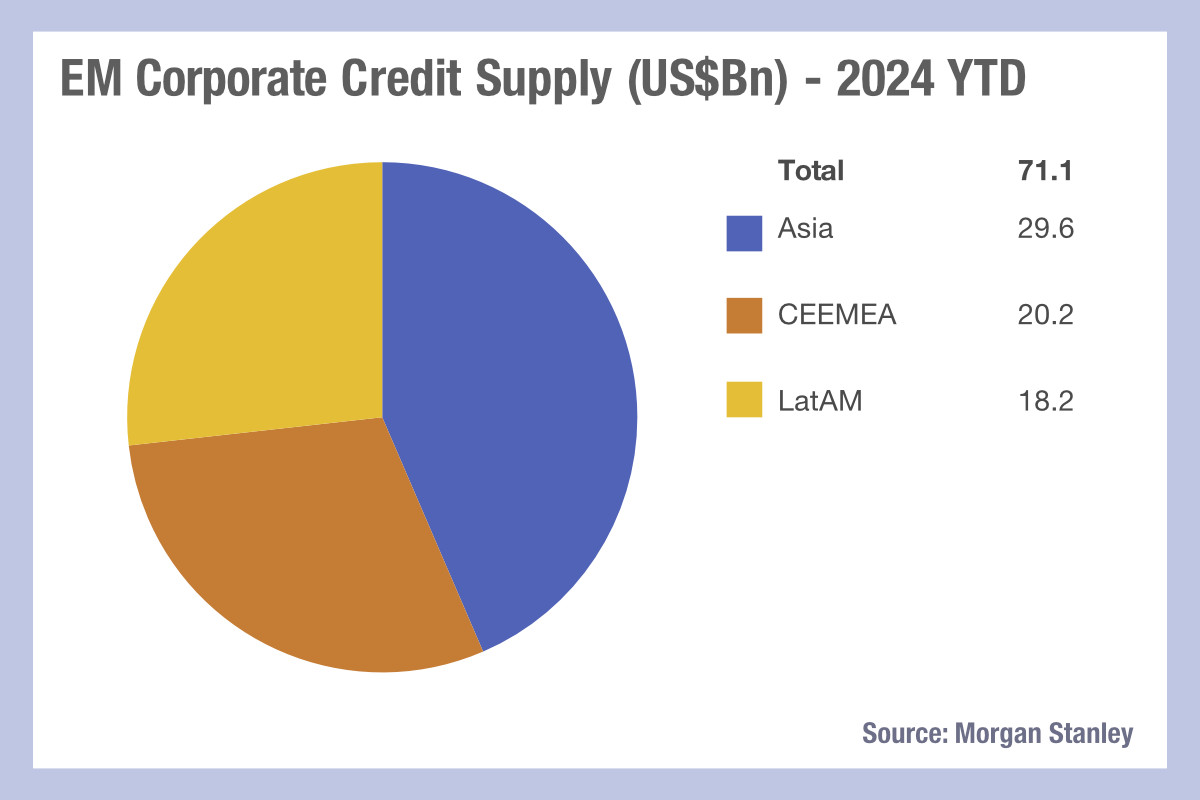

Assessment from Morgan Stanley has found sovereign hard currency gross issuance is likely to increase to US$164 billion in 2024 due to more open market access.

Last year hard currency bond issuance in European and the Middle East, North Africa (MENA) region outstripped expectations. “We estimate sovereign gross hard currency bond issuance to rise to US$164.4bn in 2024 from US$134.6bn in 2023 for [several major] countries/regions, an increase of US$29.8bn,” writes Simon Waever, strategist at Morgan Stanley. “For these sovereigns, it would mean net issuance increases by US$19.1bn to stand at US$86.7bn. Issuance for IG-rated sovereigns looks set to reach US$125bn, the second highest on record, behind only 2020. Asia, MENA and LatAm are key drivers of this high year-on-year increase for IG.”

He also noted that sovereign, supranational and agency (SSA) is another potential driver which will depending on market accessibility. “At a sovereign level, six look set to issue more than US$10bn, namely Indonesia, Poland, Turkey, Israel and Mexico, in addition to Saudi Arabia which has already issued US$12bn this year.”

For the week ending 16th February, EM outflows were at US$579m versus inflows of US$429m in the previous week, with hard currency outflows increasing slightly to US$217m versus outflows of US$168m in the previous week, according to Morgan Stanley analysts. Market capacity to absorb new issuances will be crucial this year as investors see a huge amount of new debt on the back of pent-up refinancing and potentially lower rates, as well as government spending programmes in election years, which are typically funded by incumbent governments’ debt issuance to support tax cuts.

The analysts also observed that long-end bonds are coming back with a slight recovery in long-end bond issuance in 2023 to US$17bn, up from only US$10bn in 2022. “2024 should see another increase,” they wrote. “However, most should come from IG and BB issuers, with B issuers sticking to 5-10y bonds.”

©Markets Media Europe 2024

©Markets Media Europe 2025