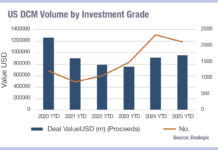

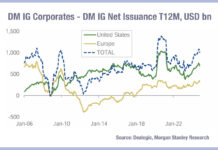

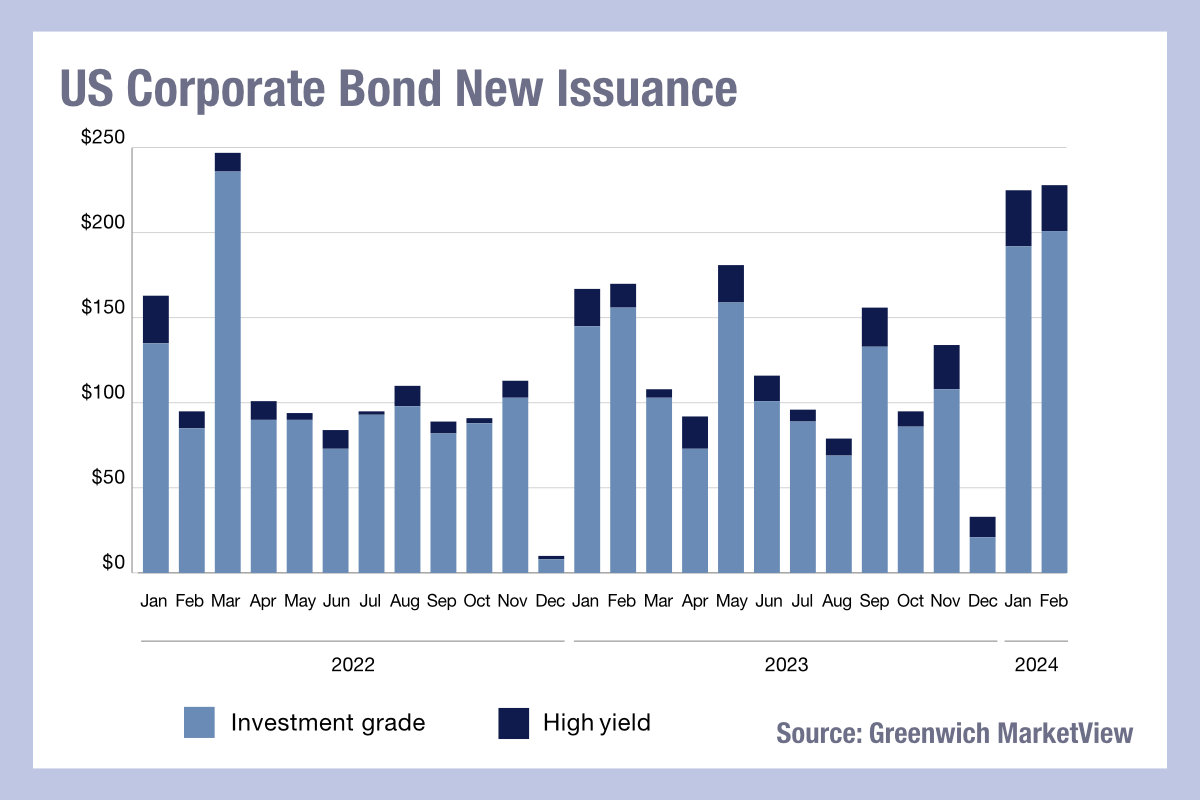

The high levels of bond issuance this year, made at what is widely expected to be peak interest rates, are potentially building up high levels of credit risk for issuers.

Although issuance has been focused on the shorter end of the curve, which will allow issuers to take advantage of rate declines in the future when they roll debt forward, the outsized levels of issuance potentially create challenges.

“Investors rotating out of money market funds into longer-term (but still safe) debt ahead of expected Fed cuts is the biggest volume driver, with a notably solid month of new issuance [in February] providing an additional tailwind for secondary market trading,” wrote Kevin McPartland, head of market structure and technology research at Coalition Greenwich, in an update on US market activity.

A recent report on the high yield market by the Association of Financial Markets in Europe (AFME) observed that credit ratings agencies were not seeing significant levels of concern in riskier debt at the end of last year; S&P reported the trailing 12-month speculative-grade bond default rate at 3.47% in December 2023, an increase from 2.16% in December 2022, while Moody’s reported the speculative-grade default rate at 3.55% in December 2023, down from 7.8% in December 2022 but up from 2.61% of March 2023.

Although those two agencies reported 17 bond defaults in Q4 of the last year, AFME observed that only one default was attributed to company bankruptcy, while S&P found 155 upgrades against 138 downgrades in developed market Europe in 2023. For the moment, with risks of a recession appearing to recede, it appears that investors are getting easy access to good deals in the corporate debt markets, especially given the positive outlooks for liquidity in secondary trading.

Nevertheless, portfolio managers would do well to keep a close eye on riskier assets, given the potential volatility created by upcoming elections and geopolitical events.

©Markets Media Europe 2024

©Markets Media Europe 2025