Some investment firms have claimed they can fully systematise credit trading by 2025, The DESK investigates.

Some investment firms have claimed they can fully systematise credit trading by 2025, The DESK investigates.

Investment managers and banks are rapidly adopting systematic approaches to trading and investing in corporate bonds, despite the apparent weaknesses in data integrity and firm pricing which exist in the credit space.

The advantages of operating these rules-based approaches are considerable, especially combined with tools and platform support.

Muting Ren, head of systematic credit at American Century Investments, says, “There is some very encouraging evidence showing that systematic strategies can generate active returns that have low correlations versus traditional fundamental strategies, so having different ways to uncover insights and to generate alpha via different investment paths, clearly expands a firm’s capability to generate alpha for the client.”

Archit Soni, portfolio manager at Dimensional Fund Advisors, believes there are three key pillars which are helping the growth of systematic credit investing and trading.

“First is regulation and the level of transparency in the marketplace,” he says. “The more transparent the market is, the greater your availability of data to test and build a rules-based approach to investing.”

That means the market structure of the region in which a firm invests sets the guide rails for a rules based approach to trading.

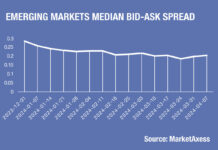

“If you look at the US, it is definitely on the front end of transparency,” notes Soni. “Europe is behind in transparency, but further ahead in electronification. Then emerging markets are behind on both.”

Once a standardised approach exists to finding the information that provides signals for a trading decision, the systems need to be developed either on a platform or within the firm to respond to that information.

“The second pillar is the electronification of trading within fixed income markets,” says Soni. “It is difficult to have systematic implementation in a market trading 75% on the phone or chat. As more fixed income markets move towards electronification, the easier it will become to capture data and trade in a structured manner.”

Implementing a strategy then requires the correct representation of a trading/investment strategy in a quantitative manner.

“The third pillar is that more and more market participants are seeing the advantages of using a rules-based approach to investing, it can be low cost, transparent and avoid style drift from human interference,” he adds. “However your ability to manage data is key. In the age of big data a lot of traders can find a pattern, but how robust are your results? How sensible are your assumptions? The answers to these questions coupled with a strong track history is really what will make you stand out.”

Taking advantage

With the ground work in place, firms can realise even more advantages than the diversified investment strategies on offer, says Ren.

“Integrating of technology and artificial intelligence in the investment process makes it more efficient and scalable,” he observes. “A systematic strategy can use intelligent agents to help the PM handle more operational work such as compliance checks, analysis, basic monitoring, and feedback about the current flow and risk constraints.”

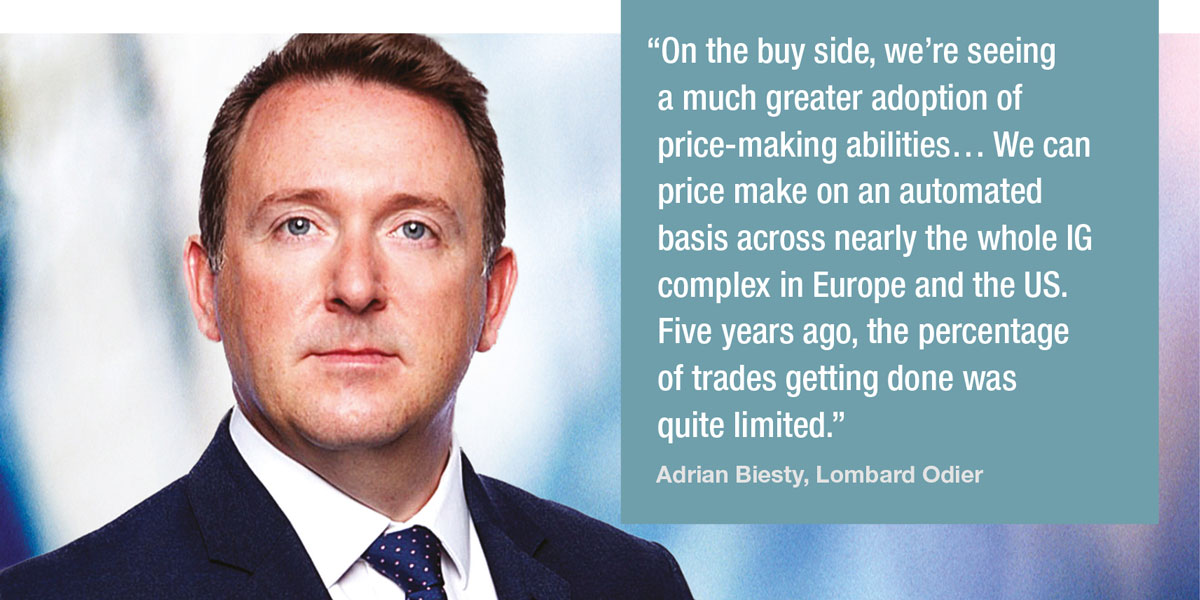

“On the buy side, we’re seeing a much greater adoption of price-making abilities,” says Adrian Biesty, head of trading at Lombard Odier. “That’s an evolution on various platforms like MarketAxess, Bloomberg and Tradeweb. We can price make on an automated basis across nearly the whole IG complex in Europe and the US. Five years ago, the percentage of trades getting done was quite limited.”

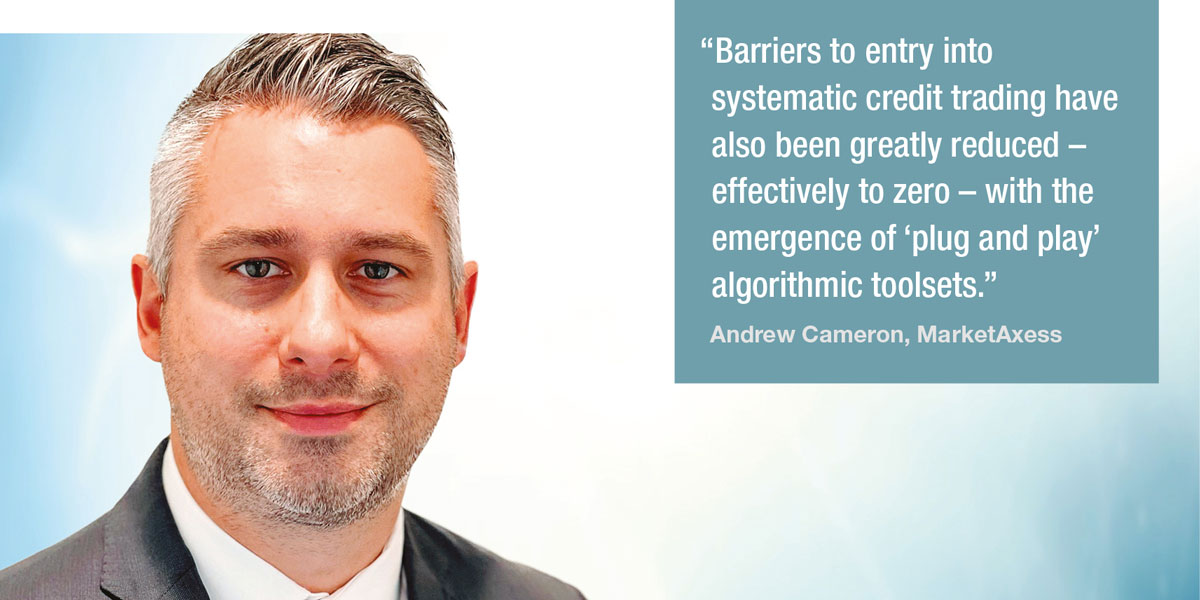

Andrew Cameron, director of trade automation at MarketAxess says, “Credit automation [of trading] originated from acute buy-side needs surrounding desk workflow efficiency and process compliance, and has since broadened to assist in both sourcing liquidity and improving execution outcomes. Rather than picking from unique protocols, more clients are now empowered to define an overlying order or basket objective across multiple protocols using robust routing and pricing technologies.”

Andrew Cameron, director of trade automation at MarketAxess says, “Credit automation [of trading] originated from acute buy-side needs surrounding desk workflow efficiency and process compliance, and has since broadened to assist in both sourcing liquidity and improving execution outcomes. Rather than picking from unique protocols, more clients are now empowered to define an overlying order or basket objective across multiple protocols using robust routing and pricing technologies.”

Biesty notes that this is allowing low or no-touch trading – including price making – which is changing the flow of liquidity provision.

“Around 10-15% of our credit flow is done on a price-made basis, which is a step change,” he says. “I’ve never had an incident where I’ve traded with another buy side through a platform where the trade has to be busted or somebody made a mistake.”

Supporting execution performance without tying up a trader’s time helps lower the costs for the end investor and deliver better performance.

“Using MarketAxess we can really tailor our automated responses with a spread basis/price basis and that’s something we don’t need to get a set of eyes on currently,” he says. “That’s a relatively new development by them and other vendors will probably follow suit. Gone are the days where you need a set of eyes staring at the screen for 12 hours a day just to market make – I could set it up on a spread basis to trade an instrument at 70 bps over the benchmark, for example, and off you go.”

Dealers respond to systematic client demands

On the sell-side, the provision of systematic trading likewise requires both technical precursors, and organisational precursors. Systematic specialists within banks say that technical precursors include the availability of data, the competency stack within a bank’s operations, and the effectiveness with which that is connected to the tech stack.

In addition, so much order flow is consumed by their clients via platforms, that both traditional and alternative liquidity providers need to ensure they have the connectivity needed to support live streaming directly and/or through a trading venue, including the provision of necessary information to the intermediaries to ensure that the bank is selected correctly by counterparties.

“Traditionally some banks had seen systematic tools as a utility for live traders to increase their capacity, almost as clever autoresponders, which could deal with high volume / low value activity,” notes a systematic specialist at an investment bank. “While there would be someone on the trading side who is the liaison, these were mainly being built by these systematic quant people and that makes it hard to evolve well in that ecosystem.”

Commercial pressure in the form of competition has driven dealers to optimise their capacity to trade more systematically.

“From the sell side, in systematic trading you see the alternative liquidity providers who really stepped up throughout the pandemic,” says Biesty. “Banks reduced their balance sheet and only really turned the taps back on when the Fed stepped in. That said, those banks were quicker to adapt than they were in the GFC.”

Risk managing support for algo market-making in volatile times is dependent upon the bank’s quantitative sophistication, and control framework. Giving it the ability to take an opportunity but manage a wider bid-offer in parts of the market that are more challenged. It also requires working with the buy side says a sell-side systematic credit trader, speaking on condition of anonymity.

“Only a few algo desks are very good at talking to clients,” he says. “A lot of investors are getting into systematic credit. Part of the business in offering the most sophisticated algo liquidity on the sell side is talking to clients and understanding what they’re doing. They are often not vocal about it for obvious reasons, but if you know what they’re trying to achieve, you can bake client objectives into your work and that will increase the liquidity you can provide them, while also protecting you from adverse market conditions, so you both win.”

This has accelerated action on the traditional sell side and encouraged a more efficient development and deployment process.

“Most banks have now gotten to a point they realise it needs to be all one team on the same desk, so the people who focus on trading are sitting right next to all the quants and the tech team,” says the systematic sell-side specialist. “Everyone’s aware of what they need to do.”

The path forward

Although systematic investment has long existed in equity markets, in fixed income it is less mature and therefore has a longer life span.

“Signals in equity have a very fast alpha decay, given how mature and sophisticated that space has become,” says Ren. “In fixed income we are still very early, so signal-wise they still have reasonable half-life or a certain signal. Once we get to the point where capacity had been taken out and you really need to out compete other market participants. That’s where it’ll be more careful with the design of trading algos. If you want to trade and liquidity is by appointment only, it may be hard to source in one or two days, and will the signal change in that time or not? If you cannot wait you need to figure out a more creative way to trade it.”

The relatively new engagement for systematic traders is also reflecting better trading signal information, says Cameron, and that has not been fully absorbed by the market.

“Accompanying this trend is more effective real-time pricing, trading signals and risk controls to help clients navigate an array of trading environments,” he says. “Barriers to entry into systematic credit trading have also been greatly reduced – effectively to zero – with the emergence of ‘plug and play’ algorithmic toolsets.”

Ren says that success in investment can be measured by looking at the discrepancy between a PM’s simulation versus a live strategy performance, but should also include the impact that greater resilience has on the market, as systematic liquidity provision becomes more reliable.

“Success should also include assessing performance in a stressed period,” he says. “How does the algo and infrastructure behave in that event versus what we saw three years ago? A key point is that while bid-ask spreads are going to widen if volatility in the market increases, as the market becomes more mature we do see liquidity being maintained where it historically may have declined.”

Having seen ETF market makers break into the traditional bank space, Biesty observes that competition and progress will inevitably increase systematic activity on the sell side.

“An obvious barrier to banks’ systematic trading is the limit on what they can hold [as inventory],” he says. “Regulation including Dodd Frank can come through and create a difference in approach. That said, there will be a greater adoption of being able to automatically price make on both sides. The seed has been sown, and it will continue to evolve apace.”

©Markets Media Europe 2023