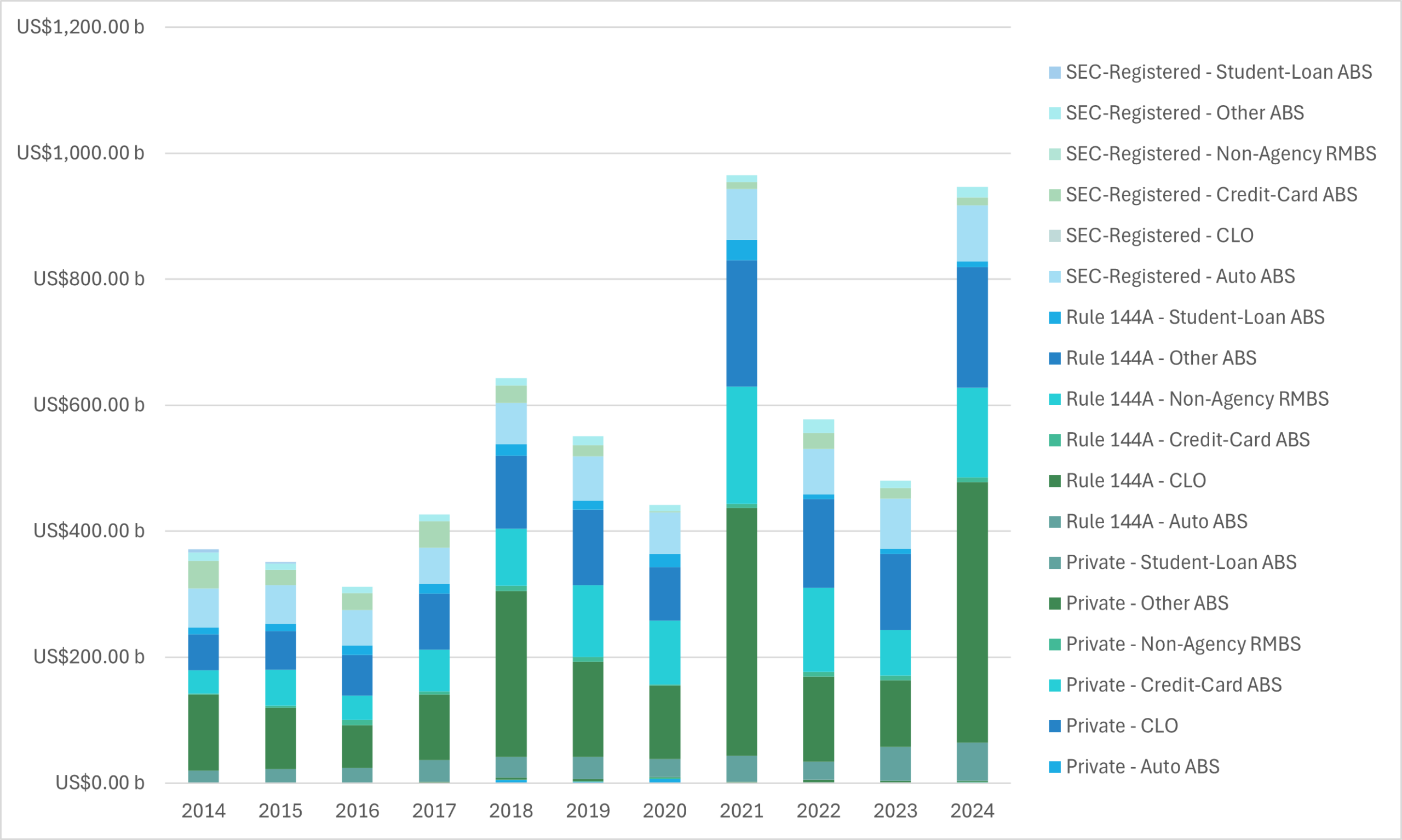

New regulatory data published by the Securities and Exchange Commission’s (SEC) Division of Economic and Risk Analysis shows US asset-backed securities issuance almost doubling in 2024, with privately placed Rule 144A deals accounting for nearly seven-eighths of the jump.

The SEC has begun a further transparency exercise by releasing the numbers it uses i its periodic white papers. In this first release from 28 April and DERA’s dataset, covering every US non-agency asset-backed security priced between 2014 and 2024, confirms that last year’s market was the second largest on record at US$946.8 billion, almost twice the 2023 total and within touching distance of the post-pandemic peak set in 2021. Rule 144A placements leapt to US$824.5 billion and accounted for 87 per cent of the year-on-year increase.

A closer look at collateral types shows how concentrated the surge really was. Arbitrage collaterallised loan obligations (CLOs), all of which are sold under Rule 144A, quadrupled to US$414 billion and made up nearly half of the market’s incremental growth. Non-agency retail mortgage-backed securities (RMBS) also revived, reaching US$145 billion, again almost entirely via private placements. By contrast, the consumer-loan segment delivered a more nuanced picture. Auto ABS set a record US$149 billion, split roughly 60-40 between registered and private deals, while credit-card issuance slipped to US$20 billion and student-loan supply continued its long decline to US$9.7 billion; both categories dominated by Rule 144A.

Registered public deals grew only modestly, finishing the year at US$118 billion, and traditional private placements remained a footnote at just over US$4 billion. That left “other” ABS, equipment leases, floor-plan receivables and small-business loans, to fill the gap, adding a further US$209 billion under Rule 144A and US$17 billion in registered format.

The data also illuminates structural trends. Median class counts ticked up across the board, with a typical CLO now sporting eight tranches and the median RMBS deal seven. Horizontal risk-retention, in which issuers keep the first-loss slice, remained the favoured compliance route, covering about 70 per cent of 2024 volume where information was available.

According to DERA, on one hand, heavier supply has tightened spreads in popular sectors such as AAA CLOs and prime auto paper, offering cheaper funding to issuers even as benchmark rates climbed. On the other hand, the rebound has brought a looser mix of collateral and more layering of tranches, features that regulators will watch closely given the leverage embedded in structured finance.

DERA’s decision to publish the underlying figures should make that surveillance easier.

©Markets Media Europe 2025