In a research piece from 21 June, Goldman Sachs economist Jan Hatzius provides an improved outlook on US economic conditions as tariffs expectations stabilised. He highlights significant risks, particularly from geopolitical tensions and unsustainable fiscal practices.

Goldman Sachs economist Jan Hatzius states, “Our projection for the 2025 increase in the effective US tariff rate has stabilized at around 14pp over the past two months, dramatically higher than the 2pp increase in the first Trump administration but significantly below the 20pp we assumed for two hours on 9 April.”

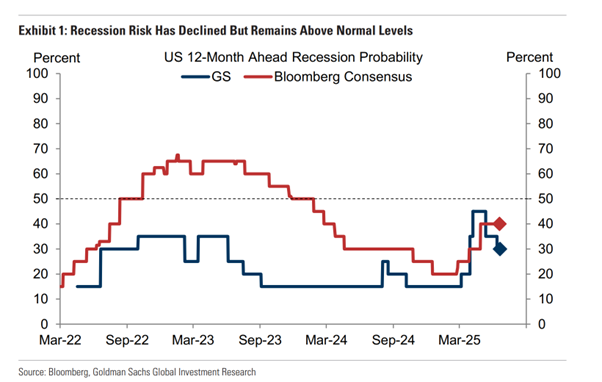

Stabilising tariffs have eased financial conditions and lowered policy uncertainty, leading Goldman Sachs to cut its December 2025 core PCE inflation forecast to 3.4% and raise its growth forecast to 1.25% on a Q4-to-Q4 basis. The bank also reduced its 12-month US recession probability to 30%.

However, Hatzius flagged geopolitical tensions with Iran as a key downside risk, “One reason not to cut our recession probability further is potential US military action against Iran. While the probability of very near-term action has declined in the last couple of days, prediction markets still see a high risk through July and crude oil prices remain about $10/barrel higher than in early June.”

On 23 and 24 June, despite US bombing Iran, oil prices sold off sharply back below pre-tension levels at the prospect of a truce.

Goldman estimates real GDP will rebound to 4.1% in Q2 after contracting 0.2% in Q1 but cautions that front-loaded effects distort the signal. Labour market indicators point to a moderate slowdown, with softer job growth, rising claims and declining participation.

On inflation, Goldman expects core PCE to register a subdued 0.18% in May. The bank says some tariff-related pressures are visible in goods prices, but the bank sees long-term inflation expectations as still anchored.

Hatzius expects only one 25 basis points Fed cut in December 2025, with two more in 2026, but acknowledges downside risks.

“It is even more important than normal to keep an open mind because the risks to this baseline are strongly tilted to the downside,” he says.

The research also warns that the fiscal outlook is deteriorating. The new ‘beautiful” budget bill under debate in Congress could raise deficits to 6% of GDP overall and 3% excluding interest payments. Hatzius says these are “unsustainable levels that will result in a rising debt/GDP ratio as far as the eye can see.”

Finally, despite stabilising US growth expectations, the dollar has continued to weaken.

Hatzius writes: “The dollar is the dog that didn’t bark, weakening further since April despite a partial recovery in relative US growth expectations.”

©Markets Media Europe 2025