Activity in both European high yield (HY) and investment grade (IG) declined in the last week of July, with trade volumes falling to yearly lows in both asset classes.

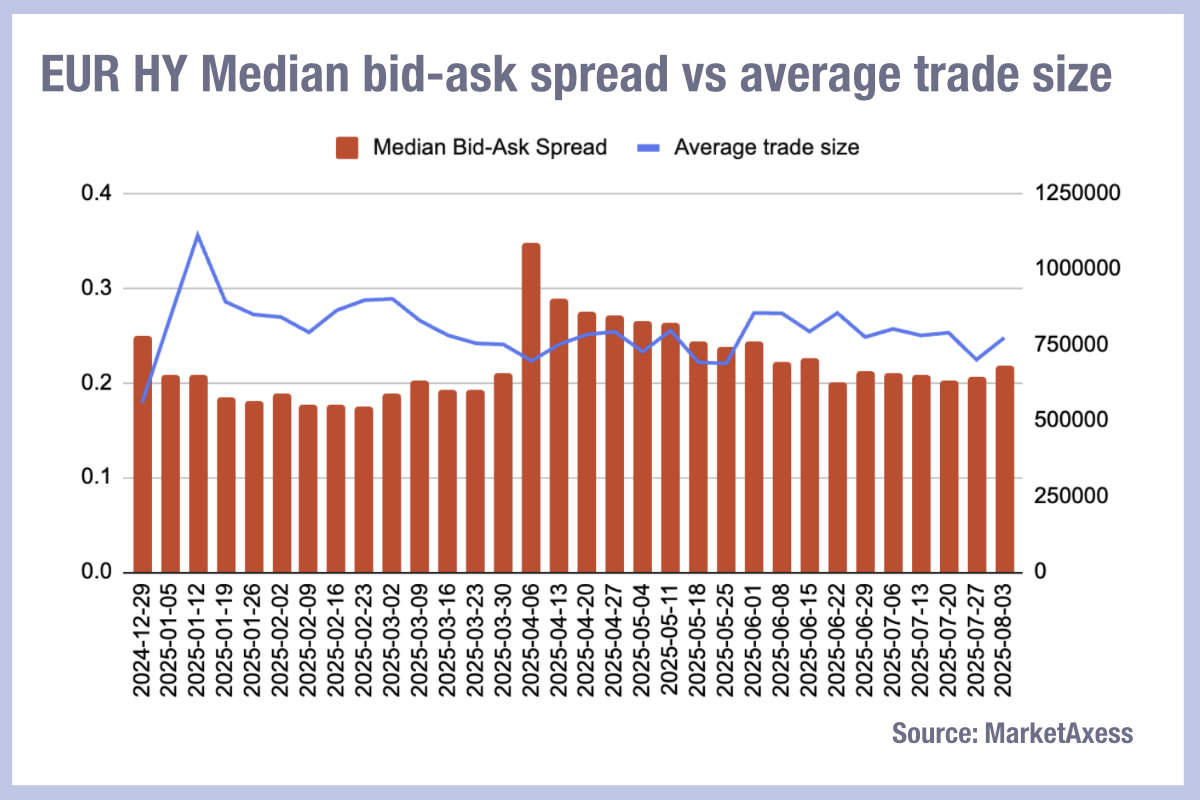

According to TraX data from MarketAxess, investors continue to trade in smaller lots across European HY. The average trade size was 768333.1 in July, down from 826434.842 in June.

Bid-ask spreads ticked up at the end of the month in HY, signifying a slightly increased cost of trading, but remain firmly below the elevated levels seen at the start of April.

By contrast, trade sizes in European IG have broadly maintained their average – although a spike in smaller trades was seen in the last week of July. Bid-ask spreads have continued to hover at post-Liberation day levels, not quite returning to the lows seen in February and March.

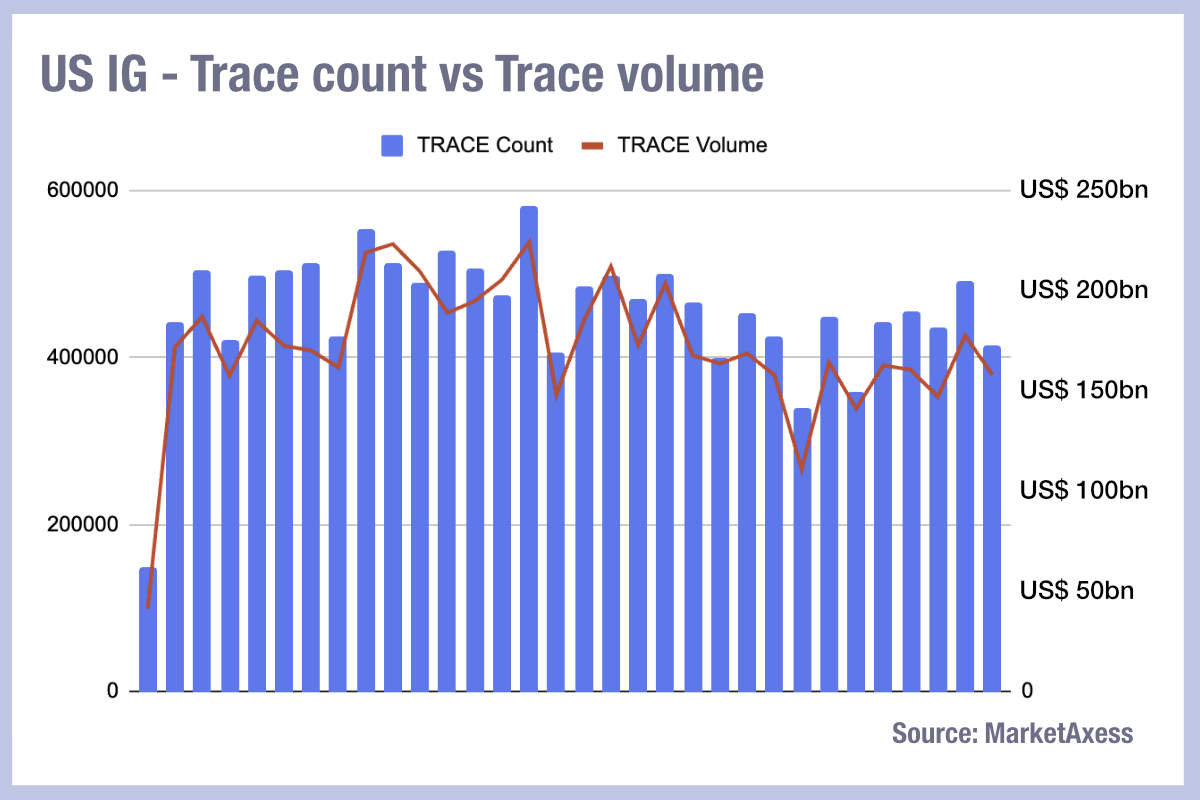

Activity in the US grew over July in both IG and HY, with increased volumes driven by smaller trade sizes. This signals a recovery from a low early-June volumes in both asset classes.

Using the bid-ask spread as a liquidity proxy, the cost of trading both US IG and HY has continued to decline since April — with a low of 0.153 in IG in the week to the 6 July, and a low of 0.0879 in HY in the week to 20 July.

©Markets Media Europe 2025