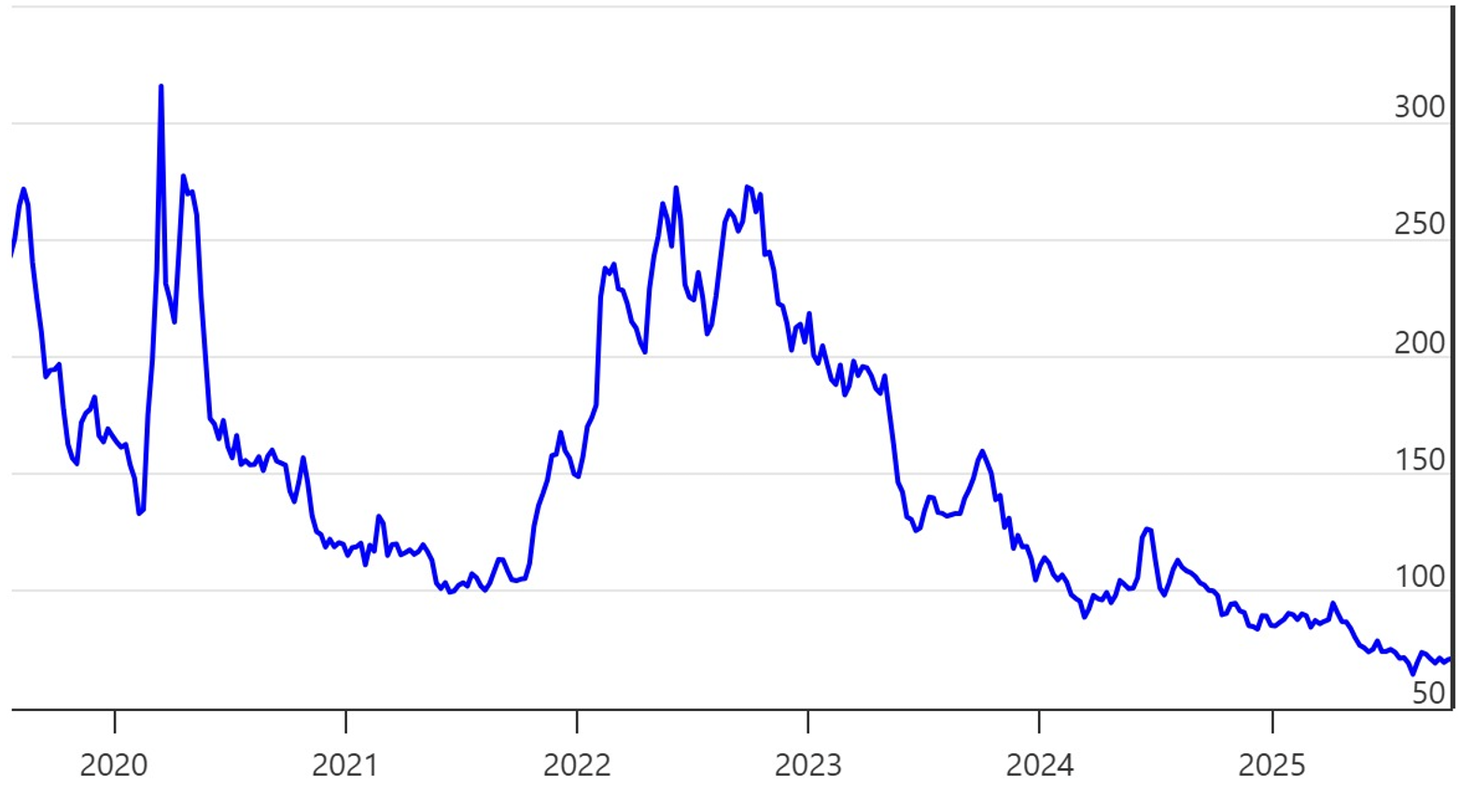

Greek spreads over German debt have tightened from 270 basis points to 70 basis points since mid 2022. Non-traditional rating agencies like Scope ratings or DBRS Morningstar, were the first to restore investment grade. Followed by the big three ratings’ agencies, Moody’s, fitch and S&P ratings. Bond prices were more synchronous to the alternatives rating agencies’ moves than to the main ones.

Rerating in price seem to have been both macro and ratings related. On the macro side primary surpluses returned and debt ratios fell sharply from their 2020 peak. Also, growth has outpaced the euro area average on the back of investment and tourism.

Alternative credit rating agencies moved first to upgrade Greece and signalled confidence from early.

Scope Ratings was the first to restore Greece to investment grade (IG) in August 2023 at BBB–, later moving to BBB as fiscal metrics and bank clean-ups progressed. It had given a positive view to its BB+ ratings in summer 2022.

DBRS Morningstar followed in 2023 with BBB- and pushed Greece up to BBB in early 2025. Other non-traditional rating agencies agreed: KBRA (the Kroll rating agency) upgraded to BBB in late 2024 and Japan’s R&I lifted Greece to BBB in 2025.

S&P and Fitch returned Greece to investment grade in October 2023 and Dec 2023 at BBB–; By end 2023 Greek bonds had already compressed to 100 basis points over German bund yields.

Moody’s was last to move in March 2025 with a move to Baa3; S&P then advanced to BBB in April 2025.

Early Investment grade upgrades from Scope/DBRS/others came in sync with compressing risk premiums, lower new-issue concessions and broadened the investability of the Greek paper.

Greek banks’ funding directly benefitted from these upgrades and turned to alternative providers for ratings.

Alpha Bank mandated Scope Ratings in 2025 and received a BBB/Stable issuer rating, an investment-grade opinion that helped it print risk capital and senior paper at meaningfully lower spreads than in 2021–22.

Eurobank and National Bank of Greece worked with DBRS and got back to BBB in 2025.

Piraeus Bank also reached BBB with DBRS in 2025

For issuers, even a single investment-grade ratings can be decisive. Many institutional buyer mandates allow purchase when at least one recognised external rates assessment institution (ECAI) rates an issuer investment grade. That nuance seems to have broadened demand for Greek risk before every big-three rating’s agencies had opined. This would have helped lowering curves for both sovereign and banks.

Performance has reflected that steady normalisation. Greeks’ spreads over bunds have compressed in distinct waves but early support from nontraditional ratings agencies were clearly well timed.

©Markets Media Europe 2025