There is a lot to be afraid of in the modern world. Geopolitical shocks, inflation and black swans abound, and the old ways do not always hold up. Panelists at FILS Europe explained how they are changing their ways, from asset allocation to embracing e-trading.

To adapt to this, investors are changing the way their portfolios are constructed. The old ‘60/40’ structure, where 60% of a portfolio is dedicated to equities and 40% to fixed income, is no longer the anchor it once was.

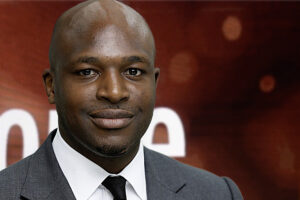

“The correlation between equities and bonds has increased, and the diversification benefit has reduced – especially during global shocks,” explained Ovie Koloko, chief product officer at Parameta Solutions.

“That balance worked over the last few decades in a disinflationary environment, but now that it’s turned more inflationary and governments are spending more, we’re working in a very different economy,” added David Fahy, portfolio manager at Goodbody. “Bonds are still a diversifier, but you need to be more targeted, and look at different parts of the yield curve.”

He highlighted credit as a particularly fertile space for allocations.

Gerard Moerman, head of core fixed income, LDI and investment solutions at Aegon Asset Management advised that investors pay attention to sovereign bonds.

“That’s one asset class that’s cheap at the moment. Credit spreads and high yield spreads are tight, equity’s in a bubble, and while private market valuations are hard to judge they move with the liquid markets,” he said. “Government bonds are relatively cheap, and you should have a fair share of them in your portfolio. They deliver yields, and they’re a good diversifier in the case of a selloff.”

To further improve resilience, it’s important to understand the underlying characteristics of a portfolio.

Fahy said. “You want your safe haven assets to actually do their job if we move into a recession. You want to be in the right area of the yield curve. Liquidity is hugely important, and you need to understand where you can source it in your asset class.”

“Be prepared,” added Moerman. “Do scenario analysis, and be ready for all kinds.”

“There’s a lot of cash in hand at the moment, and credit is getting tighter. At some points, this will turn around and there will be a risk-off scenario. Have safe haven assets in your portfolio, and be exposed to long vol strategies.”

The mechanisms used to trade are also adapting to the new environment.

Portfolio trading (PT) has exploded in popularity over recent years, allowing less liquid bonds to be bundled and traded and offering some certainty of execution. Growth has been considerable over the last five years, but panelists shared predictions that this will level out going forward.

“Government bond portfolio trading has now come to fruition. It’s especially useful for us to manage our portfolio through trading swap spreads, for example,” commented James McDonald, credit trader at the Pension Corporation.

However, one panelist noted that sometimes a month can go by without them choosing to run a PT trade. Bilateral and RFQ trading remain important, speakers emphasised.

©Markets Media Europe 2025