Global fund managers viewed the AI equity bubble as the biggest tail risk in October, according to BofA’s Global Fund Manager Survey.

Concerns grew from the previous survey, with the percentage of respondents citing the issue growing from 30% in October to 45% in November. However, the number of participants who believe that AI stocks are in a bubble has dropped slightly over this time – albeit by a single percentage point, to 53%.

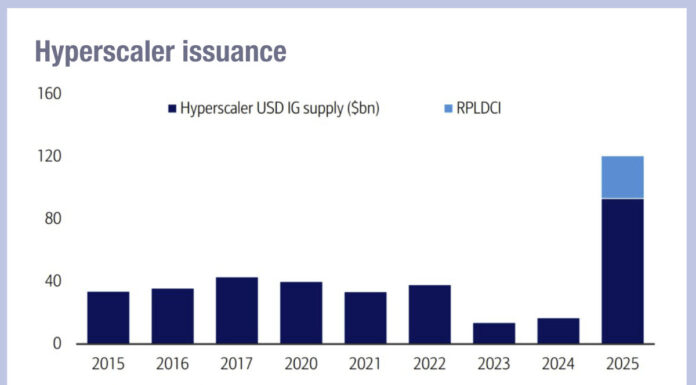

A record 63% of participants believe that global equity markets are overvalued. For the first time since August 2005, the majority (net 20%) of investors believe that companies are overinvesting. “This jump is driven by concerns over the magnitude and financing of the AI capex boom,” BofA’s report comments.

For the bulk of 2025, the central tail risk has been related to the US and global recession, emphasised by tariffs and trade wars, and ongoing geopolitical conflict worldwide.

In line with this, the most crowded trade this month is long Mag7 (per 54% of respondents). Companies in this group, including Nvidia, Alphabet, Meta and Microsoft, are all investing heavily in AI.

Long Mag7 has held the “most crowded trade” title near constantly since mid-2023, with its crown knocked slightly over recent months by long gold and short US dollar trades.

©Markets Media Europe 2025