With the implementation of MiFID II in 2018 came the unbundling of payments for investment research from trading commissions. The perceived benefit of unbundling was to provide investors with greater transparency over the products (research) and services (execution) they were buying.

The assumption was that by unbundling trading from research there would be more incentive for research providers to produce research for small and mid-cap companies. However, SME research in the UK has not increased and the country’s review of financial regulation following its departure from the EU has led to suggestions that recombining research and commission payments could be the answer to this problem. According to Managing Partner at Redlap Consulting Rebecca Healey, it simply isn’t.

“The panellists at this year’s FIX EMEA Conference were unanimous on this on this subject,” said Healey. “Rebundling research will not result in any significant increase in SME coverage. One panelist noted they have access to all the small and mid-cap research they need. The issue is more due to a lack of investor appetite in small and mid-cap UK companies, and this is exacerbated by a lack of liquidity.”

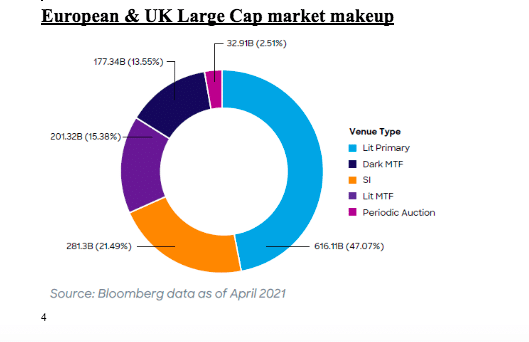

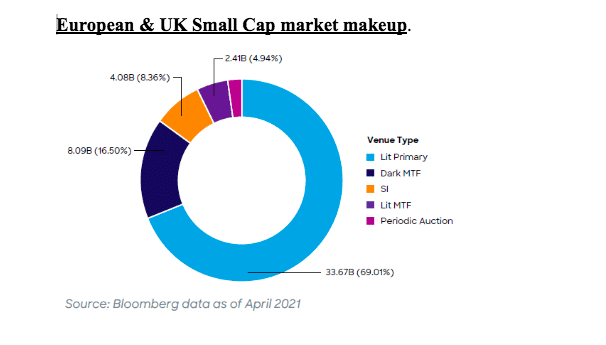

“You can write as many SME research reports as you want but that is not going to solve the issue. There has to be much more around specialist provision of liquidity,” Healey added. The levels of activity in small and mid-cap securities remains small, with these segments accounting for less than 18% of the total executed value traded (1).

As highlighted by one buy side trader in a previous report Liquidnet produced… “I don’t trade SME stocks when I want to, I trade them when and where I can.” (2) “The way the government is looking to solve the problem is by reversing back to a traditional practice of providing greater research on SMEs. This will not give them the outcome they are looking for. Any investment requires execution of that strategy in order to work,” explained Healey.

This has led to a fundamental global shift in how data and analytics can best support investment. Investors want machine readable data on companies, rather than having to wade through research reports from analysts to better understand where, when and how to trade. As a result, the way investors ingest information has changed. In addition, the information to support any investment idea has radically changed. For example, companies need to provide new types of information on ESG and are still learning what that is as regulations are evolving.

UK review

In December 2022 the UK government announced the launch of an independent review of financial services investment research and its contribution to UK capital markets competitiveness. This is part of the government’s aim of increasing the attractiveness of the UK as a location for large and small companies to raise capital both in private and public markets, and to assess the link between research and the attractiveness of the UK as a listing destination.

All interested parties, including buy-side and sell-side firms, listed and unlisted companies, investors, independent research firms, trading venues, and legal and academic professionals, were invited to provide their views. Healey said: “I believe that a successful outcome of the review is not how to improve traditional analyst coverage in SME stocks, but rather how the finance industry is better able to access relevant information, how it is evaluated and who is best placed to distribute this at the most effective price point globally 24/7 –accessing liquidity in order to make an investment or exit a strategy.”

“It’s not only more machine readable data, but it’s machine readable data from completely different sources.” Healey added. “This is still very much up for grabs and investors are working out where they can source the relevant information they need.”

Liquidity

Policy makers may perceive it is a lack of research that limits secondary liquidity, asset managers will argue that it is the lack of secondary market liquidity which prevents them from investing in SMEs. For SMEs to be successful they need to raise capital, however, they not only have to be covered by an analyst—the fund mandate needs to permit investment in SMEs. Daily fund liquidity rules alongside declining secondary market activity makes it harder for risk committees to justify any investment in an illiquid instrument.

The recent high-profile Woodford scandal and the subsequent increased regulatory focus on managing liquidity stress (3) within portfolios only amplifies this. Historically, liquidity in SMEs was provided by dedicated dealing desks at bulge bracket banks but this has been impeded by the increase in electronic market-making, sporadic SME trading volumes and very low commission rates for equities trading. Looking at how small caps are traded, a large proportion are still tagged as off exchange further evidencing the sell-side is putting orders together and printing on venue at the end of day.

In addition SIs activity tends to increase as we go up the market cap spectrum, highlighting that it is more profitable for a bank to cover a large cap as it will be rewarded with volume as opposed to a small cap.

In addition SIs activity tends to increase as we go up the market cap spectrum, highlighting that it is more profitable for a bank to cover a large cap as it will be rewarded with volume as opposed to a small cap.

The traditional role of facilitation in uncovering liquidity needs to upskill for 21st century trading. If you are looking to make an investment in a stock that is 250% of ADV understanding the liquidity events around earnings is not enough. Particularly given that there is no global exchange concept and downloading regulatory filings is a nigh on impossible task.

You need full visibility to trading activity – lit and dark to build a better picture on how secondary market activity occurs and how it can be created. New tools such as targeted invitations and PM watchlists have evolved the use of analytics in establishing where liquidity in an instrument is pooling or when an issue was last traded to maximise the available alpha opportunities as well as ensure delivery of best execution.

Liquidnet have demonstrated the potential of this to create the ability to trade – and therefore invest in a small and mid-cap stock. For example Liquidnet members executed 1.6% of the outstanding shares in Direct Line (UK mid cap security) through a combination of block crossing, algorithms and service and engagement from the Block Coverage desk who liaised with counterparties to help liquidity discovery. Rebundling research alone cannot deliver the ability to trade – that will be how investors are best able to support SME growth in the UK.

1.Source: Bloomberg data – January to April 2023. Addressable EMEA executions 2.Source: Liquidnet report – Bringing SME back into Capital Markets – Solving the SME Conundrum; Part three – Rethinking trading for SMEs 3.https://www.fca.org.uk/news/statements/fca-statement-regarding-potential-enforcement-action-against-link-fund-solutions-ltd 4.Source: Liquidnet report – Bringing SME back into Capital Markets – Solving the SME Conundrum; Part three – Rethinking trading for SMEs.