This page is dedicated to research articles with secondary market data provided by MarketAxess. For further information please contact Dan Barnes.

Home ‘BoB’ – Barnes on Bonds

‘BoB’ – Barnes on Bonds

SECONDARY MARKETS

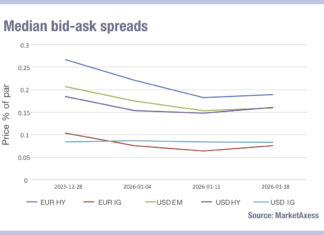

Risk-off showing in corporate bond trading costs

The rigid grip on safer assets that investors have taken over the past two weeks has clearly shown in trading costs as bid-ask spreads begin to widen in credit markets, according to MarketAxess data....

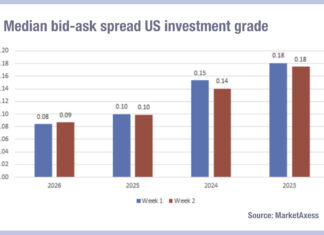

Visualising the cost of credit trading cut in half since 2023

Credit markets have seen bid-ask spreads, a proxy for trading costs for the buy-side, tighten further in the first two weeks of 2026, relative down 50% on the spreads seen in 2023 for investment...

PRIMARY MARKETS

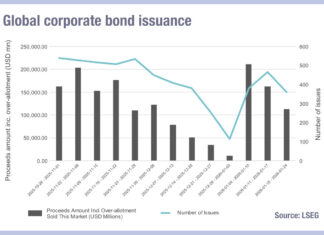

Big deals in January as UBS predicts record year for US issuance

Corporate bond issuance started the year hot, with over US$211 billion issued globally in the week beginning 4 January, however numbers dropped off pretty fast, relative to recent months, according to LSEG data.

Year-to-date the...

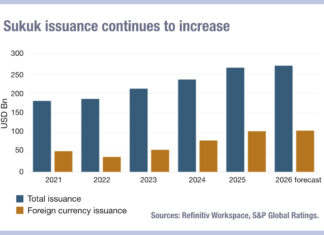

S&P Global: Record sukuk issuance in 2025

S&P Global has reported that global sukuk issuance hit US$264.8 billion in 2025, up from $234.9 billion in 2024, driven by solid economic growth in major Islamic finance countries, with high financing needs and...