Market participants need both quantity and quality of data. You asked for it. We’ve got it.

Market participants need both quantity and quality of data. You asked for it. We’ve got it.

In the global fixed income markets, more accessible and meaningful data has become critical as the seismic shift towards electronification continues, and market volatility has increased. But whereas equities participants typically only rely on order book data, in the fixed income market, following the introduction of MiFID II, there has been an explosion in the array of different data types and sources from which to choose – and not all of it is of the best quality.

Truly high-quality market data provides a compass to navigate unchartered waters, such as those in which the global fixed income industry currently finds itself.

In particular, participants have been seeking to expand the range of sources of firm data to act as a benchmark for trading decisions. To operate effectively in volatile markets, participants need trustworthy data sources that provide detailed coverage of the markets in which they trade. Nowhere is this need more pressing than in the European government bond markets.

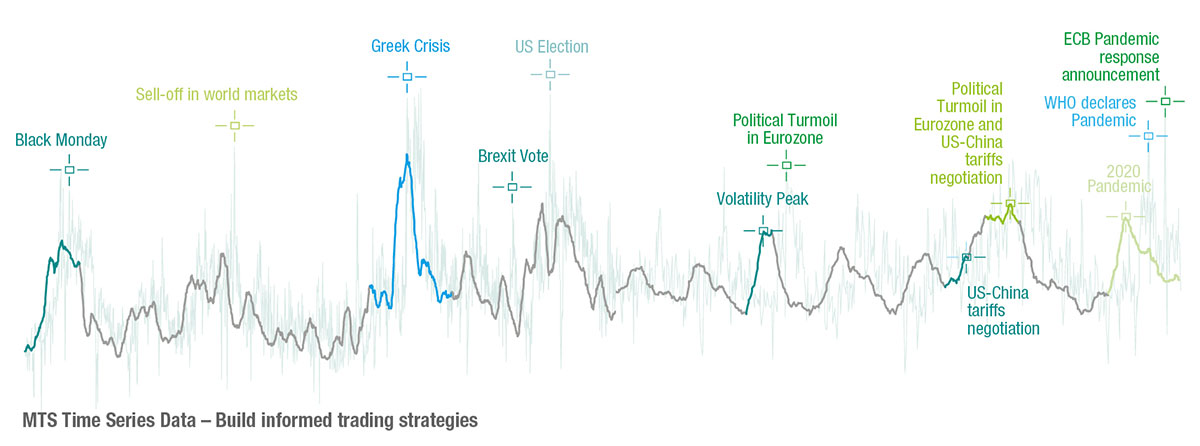

Against this backdrop, the ability to access real-time and executable prices from a broad range of markets is more essential than ever, helping participants to build a better picture of price formation to inform effective trading strategies. ‘Big data’ alone is no longer enough – it must be of exceptional quality before innovative analytics tools can be applied to it to convert raw information into valuable insight.

MTS offers either high-quality, detailed data packages via proprietary API and data vendor feeds (including Bloomberg, Class Editori, ICE, SIX Financial Information, FIS, Refinitiv, Infront and Morningstar) or an advanced trading GUI that displays real-time price information direct from our leading interdealer European government bond markets.

Our real-time cash bond data provides continuous pricing information throughout the trading day with depth and all associated volumes, sourced from a trading community of over 500 unique counterparties and average daily turnover exceeding €130 billion.

Our real-time cash bond data provides continuous pricing information throughout the trading day with depth and all associated volumes, sourced from a trading community of over 500 unique counterparties and average daily turnover exceeding €130 billion.

Additionally, our BV Composite offering is derived from the latest real-time quotes received from our extensive network of BondVision dealers on the trading platform. It is designed to provide an accurate indication of market level for EGBs, Gilts, SSAs, and covered bond sectors.

In the swaps market, we have partnered with TraditionDATA, the data arm of Compagnie Financière Tradition, to create a new data service that consolidates MTS’s real-time French, German, Italian and Spanish government bond data with real-time EUR interest rate data from Tradition’s OTC derivatives trading platform, Trad-X, to produce related Asset Swap Prices.

We recognise that for many participants, speed is also key. Low-latency market data is now firmly established as a critical component of today’s fixed income markets, enabling participants to feed trading strategies and meet best practice requirements. Access to quality, high speed data and analysis is the number one priority and challenge for many buy-side dealing desks.

To this end, we recently launched MTS Alpha, a real-time unnetted and ultra-low latency tick-by-tick price feed for bond future deliverables that hit the MTS Cash markets in France, Germany, Italy and Spain.

Data analytics and artificial intelligence are changing the face of financial markets, and fixed income is no different. With the right tools, insight into liquidity can be unleashed to huge advantage – but only if the data is from the purest source of electronically traded prices.

To address the increasing needs for liquidity assessment within the bond markets, MTS and Yield Book recently introduced a collaborative set of pre-trade and post-trade analytical measures for the European government bond market.

The service combines MTS’s wealth of time series data with Yield Book’s advanced analytical models, to help clients with their liquidity risk research and decision-making needs. It offers a robust methodology for calculating theoretical liquidity, including securities that have not traded recently, access to pre-trade and post-trade liquidity metrics across multiple order book levels, and over five years of historical liquidity metrics data, allowing backfilling.

As electronification continues and participants become more sophisticated, the need for quality and comprehensive data is only set to continue. We look forward to continuing to innovate to support the diverse needs of different market participants during this period of evolution in our industry.

About MTS

MTS is one of Europe’s leading facilitators of electronic fixed income markets, connecting a network of over 500 unique counterparties across Europe and the US, with average daily volumes exceeding €130 billion in 2020. MTS is part of the Euronext Group.

©Markets Media Europe 2025