AI is giving credit traders extra digits

Artificial intelligence is helping to refine bond‑trading workflows with a speed and depth that would have seemed improbable even a few years ago. Fixed‑income...

Cross-asset TCA is viable in credit markets

Can transaction cost analysis (TCA) provide an apples-for-apples comparison of buy-side trading costs across different asset classes? Imposing a single measurement framework across markets...

Are bigger trades always better?

Average trade sizes appear to have been increasing in corporate bond markets in recent years. Superficially this might suggest a greater dealer capacity to...

Opportunities in e-trading credit derivatives

Credit futures and swaps complement each other by providing investors with different but interconnected tools to manage credit risk, hedge exposures, and to gain...

How a credit sell-off might unfold…

Someone, somewhere, is cooking the books

In 2007, I explained the risks of cumulative capital market investments to a friend as a series of interconnected...

I just dropped in to see what condition my credit was in…

Credit conditions are in the headlines following several private credit defaults, and the debt-fuelled, forward investment in data centres which are expected to underpin...

Secular vs cyclical: How e-trading, issuance and credit spreads align with liquidity

Primary markets are a crucial source of liquidity in secondary markets, as new issues trigger a round of buying and selling activity for newly...

Aligning the pre-trade credit liquidity picture and the execution goal

Pre-trade data and market colour are imperative for buy-side traders looking to achieve best execution in corporate bond markets. Understanding how that applies to...

It is EMS time for credit traders

The value proposition for execution management systems (EMSs) in fixed income markets has seen an about face in the past year. Buy-side firms who...

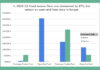

Credit is climbing, but unevenly

Analysis by S&P Global Market Intelligence charts the rise of credit markets over the past year, and finds index levels are by 10-15% of...