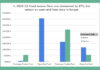

Corporate bond trade sizes climb in Europe

Total notional traded in European corporate bonds reached €5,397 billion in 2024, according to ICMA’s latest Secondary Market Data Report, an 11.8% increase on...

Direct streaming on credit trading platforms

Sell-side bond trading counterparties price trades according to their clients’ profiles, based on tiering systems. That model directs the pricing of risk according to...

Crunch on liquidity costs

As bid-ask spreads begin to widen on both sides of the Atlantic, buy-side credit traders need to reassess how to best manage the crunch...

The right way to trade credit

Of course, there is no right way to trade all credit, but there are clearly advantages in trading credit in such a way that...

Can TCA work for voice/chat credit trades?

Transaction cost analysis (TCA) – or execution quality analytics (EQA) – is a much sought after, but often objectively challenged, service in corporate bond...

Credit hungry in 2025

The market is clearly very hungry for more credit, a positive signal given how much new and refinanced debt is being issued.

This can most...

The cost of transparency and the value of information

Transparency can smell like information leakage by any other name, to butcher a Shakespeare quotation. Giving up information needs to happen at the latest...

The interplay between the cash and derivative credit markets

For investors, the derivatives market is a potentially a rich source for investment returns and risk management. It can also be a valuable source...

Could a secondary market work in private credit?

There is very limited access to secondary trading in private credit. Given the direct exposure to creditors, this might present a liquidity bottleneck for...

Tourist traps in the credit market

Dipping in and out of credit markets can reduce the value of investments for the non-specialist, but also for more experienced investors.

In their 2014...