Michelle Neal: On taking great responsibility

Having managed the market divisions at several top-tier financial institutions, Michelle Neal is now responsible for supporting the most significant fixed income market in...

Market Structure: New risk and liquidity in the US Treasury market

Significant changes in counterparties and market structure have transformed US Treasury market activity.

Dealer-to-client trading has overtaken interdealer markets in volume traded according to analyst...

LSEG names Charlie Walker London Stock Exchange deputy CEO

The London Stock Exchange Group (LSEG) has named Charlie Walker as deputy CEO of the London Stock Exchange (LSE).

Walker, who will also join the...

Tradeweb saw ADV in August up 41% YoY to $1.44 trillion

Tradeweb, global operator of electronic marketplaces for rates, credit, equities and money markets, has reported total trading volume for August 2023 of US$33 trillion....

MarketAxess sees big increases in Eurobonds and emerging markets ADV in August

MarketAxess, electronic trading platform for fixed-income securities, has seen its total credit average daily volume for August 2023 inch up by 2% YoY, while...

SIX Swiss Exchange sees 36.5% jump in ETF trading turnover, but fixed income fails...

The Swiss stock exchange, operated by SIX, saw a notable increase in exchange traded funds (ETFS) activity for August – with 5.7 billion turnover...

CME Group to launch US Treasury Bill futures

CME Group is set to expand its benchmark interest rates offering with the launch of US Treasury Bill (T-Bill) futures on 2 October.

The new...

Coccoluto and Fromer to head global fixed income trading at Manulife IM

Chris Coccoluto has been promoted to co-head global fixed income trading at Manulife Investment Management, from his role as head of investment grade (IG)...

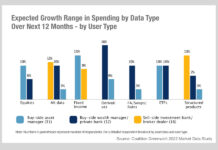

Coalition Greenwich: Buy-side data spend sees highest growth in fixed income

Spending is up across all categories of market data, with equities, fixed income and derivatives all expected to see a rise of more than...

CME Group folds FX futures, options, cash and OTC FX business into single unit

CME Group has folded its FX futures, options, cash and over-the-counter (OTC) FX businesses into a single unit led by Paul Houston which the...