LSEG: The outlook for muni bonds (video)

Global Trading editor Laurie McAughtry (on behalf of The Desk) was delighted to sit down with Domenic Vonella, director of US municipal bonds at...

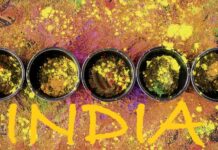

Why India’s bond markets may bloom in June

Inclusion in one major index could see Indian markets boost investment and liquidity, with more in January 2025.

Following the victory of the BJP in...

Primary ignition – at both ends

Politics are being side lined in the battle for efficiency in primary markets for buyers, and for issuers.

The top operational priority for buy-side, and...

EXCLUSIVE: abrdn’s automation journey sees no-touch jump

Louise Drummond, global head of investment execution at abrdn, discusses the firm’s path towards workflow automation – an achievement that has been almost a...

BondVision prepares for T+1 shift

MTS’s BondVision (part of the Euronext group) has updated its default settlement offset to T+1.

In anticipation of the North American transition to a shortened...

Coalition Greenwich: Return on investment now viable for fixed income EMS

Dated fixed income markets are set to undergo a rapid technological transformation. But it is from a low bar, with fixed income 10 to...

Subscriber

Credit Spotlight: How clear can pre-trade get?

Pre-trade transparency is a nirvana for over-the-counter markets, particularly corporate bond trading, which lack the publicly displayed prices of the exchange-traded market.

Unless it...

Swaps market implies no rate change from FOMC

Data from the swaps market implies participants expect to see policy rates unchanged after the Federal Open Markets Committee (FOMC) meeting this week.

Looking further...

CME’s US corporate bond index futures to launch 17 June

CME Group has revealed that its new credit futures are scheduled to begin trading on 17 June 2024, pending regulatory review.

Launching alongside the company's...

JP Morgan strides ahead in bond market-making revenues for Q1

JP Morgan saw robust fixed income revenue in Q1 2024 across US market makers, reporting US$5.2 billion over the first three months of the...