Fund managers report more certainty in EM than in developed markets

The key takeaway from the first plenary session at the Fixed Income Leaders Summit in Amsterdam was clear; in 2026, uncertainty has become a...

Data and diversification key to solving liquidity woes

The market is fond of complaining about the lack of liquidity in markets. But panellists at this year’s FILS Europe argued that there is...

Bloomberg’s open chat API creates exciting but costly opportunities

Bloomberg’s cross-firm chatbot API service can save companies time as they share information. But they are also expensive, and present firms with a fresh...

FILS EU 2025: Traders need to take control of their future

While the European and UK consolidated tape fiascos are dominating gossip around the Fixed income Leaders Summit in Amsterdam, other big themes are clearly...

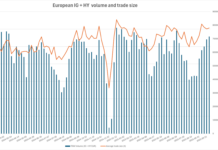

European credit trades size up 15% year on year Q3

European credit trades keep getting larger. The notional blended trade size for Investment grade and high yield European credit was €786k in September 2025...

Market awaits CT news amid cross-Channel delays

Market participants have been asking for a bond consolidated tape for years; and they’re going to have to wait a little longer than planned,...

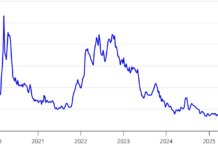

‘Alternative’ rating agencies’ early Greece upgrades led Moodys and S&P

Greek spreads over German debt have tightened from 270 basis points to 70 basis points since mid 2022. Non-traditional rating agencies like Scope ratings...

Don’t Panic: How French credit has proven market Zen

The resignation of the French Prime Minister, Sébastien Lecornu, on 6 October came after less than a month in office. Being the third prime...

TransFICC: Portfolio Trading

Portfolio Trading – Technology is the Answer

Portfolio trading (PT) is transforming the Fixed Income market. It is no longer niche – in the US...

Cboe: Navigating Volatility

Navigating Volatility: The Rise of Cboe Credit Index Futures in a Transforming Bond Market

In an era defined by macroeconomic uncertainty and digital transformation, credit...