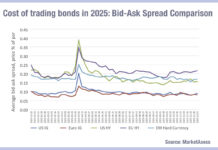

Bid-ask spread volatility highest in US bond markets

When comparing liquidity across markets in 2025, buy-side bond traders may consider European investment grade markets to have an optimal set of characteristics. However,...

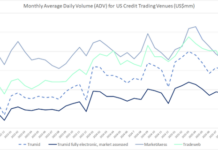

Tradeweb and MarketAxess beat TRACE growth in November

US electronic credit activity firmed in November. On FINRA’s TRACE tape, combined US investment-grade and high-yield average daily volume (ADV) rose to US$57.8 billion,...

What Mexico’s vol risk means for trading LatAm bonds

In Latin American (LatAm) markets, economic volatility may transfer into market volatility – most notably in Mexico.

In order to manage risk and seize opportunities...

EM traders ride out the chaos

It would be understandable if trading in emerging markets (EM) debt were becoming more expensive as risk increased in many markets it makes up,...

“There is still an edge in systematic trading”

Systematic trading is often associated with highly liquid instruments, but asset managers have outlined success stories in less liquid debt markets, at the Fixed...

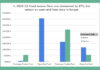

Exclusive: US analysis of Trading Intentions Survey 2025

This year we're diving deeper into the Trading Intentions Survey. to give a more nuanced view of buy-side engagement with trading services, platforms and...

Subscriber

Selling the dip

Credit investors may see the relative calm in the market at present as a point at which to trade into safer positions, according to...

Emerging markets see liquidity costs decline

The cost of liquidity in emerging markets appears to be falling for fixed income traders. Looking at MarketAxess’s CP+ consolidated price feed, and cross-referencing...

Discussions between TP ICAP and Neptune reported

Multiple market sources have reported that discussions between pre-trade data provider Neptune and TP ICAP, the multi-asset trading, interdealer broker and data services firm,...

Measuring implicit costs and market impact in credit trading

Evaluating the quality of a bond trade is made complex by the multiple dynamics which impact quality, and the frequent absence of data to...