Scottish ‘vanity’ issuance project puts investors at risk from independence

The Scottish Government has confirmed plans to enter the bond market and issue £1.5bn of debt in 2026-2027.

Ben Ashby, chief investment officer at...

Ratings and Analysis: Is the life insurance the wobbly leg of finance?

US life insurer, Brighthouse Financial, was downgraded by ratings agency Fitch on Monday, following the announcement it was to be acquired by private investment...

Strategically automate and allocate to survive

There is a lot to be afraid of in the modern world. Geopolitical shocks, inflation and black swans abound, and the old ways do...

“A fixed income price is not a fact. A fixed income price is an...

David LaRusso is the head of fixed income trading at Dimensional Fund Advisors, and has just celebrated his 25th anniversary at the firm. The...

Bond traders predict data science/AI use explosion in 2026

The DESK’s Corporate Bond Liquidity Access Survey, supported by LTX, finds trading desks are on the cusp of change.

Buy-side traders see 2026 as a turning...

Subscriber

Investor Demand: IG private credit creates ‘attractive entry points’ for investors

Research by Aviva Investors has broken down the illiquidity premia paid via private debt markets, noting that it is improving for investors, even as...

Complex environment requires multi-model approach to data science

In fixed income, the most effective investment and trading models can be those built to withstand uncertainty. Speaking at the Fixed Income Leaders’ Summit...

“There is still an edge in systematic trading”

Systematic trading is often associated with highly liquid instruments, but asset managers have outlined success stories in less liquid debt markets, at the Fixed...

Five ideas from FILS for buy-side traders

The Fixed Income Leaders’ Summit US kicked off on Monday 9 June in Washington DC, with the buy-side traders’ day. While no reporting is...

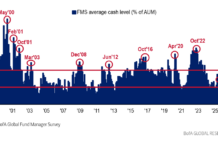

Investor Demand: BofA sees investor sentiment bounce back in May

The Bank of America Global Fund Manager Survey (FMS) has seen the scaling back of US-China tariffs as a net positive for activity. In...