EIB prices first sterling digital bond

The European Investment Bank (EIB) has priced its first ever £50 million digital bond using a combination of private and public blockchains operated and...

Dealers warned about counterparty credit risk by ECB head

Using a blog post, Andrea Enria, chair of the Supervisory Board of the European Central Bank (ECB) has highlighted risks facing the sell-side around...

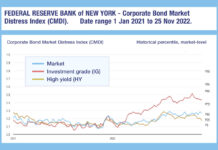

Substantially higher US investment grade stress going into 2023

The Federal Reserve Bank of New York’s Corporate Bond Market Distress Index (CMDI) is closing 2022 with investment grade US bond markets twice as distressed as...

New York Fed economists see US Treasury liquidity at crisis levels

Current US Treasury market liquidity is comparable with the 2007-09 global financial crisis and the March 2020 crisis, particularly for the two-year note, according...

US agencies report on US Treasury market changes; market making still out of scope

A new report entitled, ‘Enhancing the resilience of the US Treasury Market’, has outlined the steps taken by US authorities to support what it...

The Fed’s TMPG begins consultation on clearing and settlement in US Treasury repo

The Federal Reserve Bank of New York’s Treasury Market Practices Group (TMPG) has released a consultative white paper on clearing and settlement in the...

ICMA recommends ECB follows Federal Reserve and SNB policies

The International Capital Markets Association (ICMA) has written to the European Central Bank (ECB) with a “concern that rising dysfunction in the market...

Federal Reserve: Dealer sensitivity major barrier to all-to-all trading in US Treasuries

A new staff paper published by the Federal Reserve Bank of New York has found there are possible advantages in delivering all-to-all trading to...

BoE’s limited window could punish the gilt-y

The Bank of England’s limited UK government bond (gilt) purchase operations have been confirmed to close on Friday, putting tight brackets around buy-side firms’...

Bank of England releases detail on index-linked gilt purchases as LDI woes continue

The Bank of England (BoE) has said it continues to monitor developments in financial markets very closely in light of the significant asset repricing...