IRS electronification: 20 years in the making

With the 20th anniversary of Tradeweb’s interest rate swaps (IRS) marketplace around the corner, the firm’s head of US institutional Rates, Bhas Nalabothula, looks...

Opinion: Competition, not regulation, will make better bond markets

European credit trading has historically seen levels of electronic trading of around 50% of total corporate credit trading, while the US market has historically...

CME Group reports first week US credit futures trade count

Market operator CME Group reports its new US Credit futures have traded 415 contracts since their launch on 17 June 2024.

“In just one week...

Analysis: Electronic trading across US and European bond markets

Electronic trading of US credit erupted in May 2024, according to analysis of the US credit market by Coalition Greenwich. It found that investment...

Subscriber

Hahn vows to continue drive for EU bond sovereign status

Johannes Hahn, commissioner responsible for budget and administration at the European Commission (EC) has said the organisation intends to continue its push for bonds...

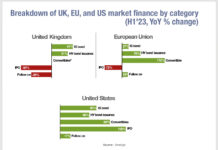

Issuance of debt increasingly financing UK companies

Analysis of corporate financing across European, UK and US markets by the Association of Financial Markets in Europe (AFME) has found that over the...

FILS USA: How ETFs drive adoption of new trading protocols

The critical role that portfolio trading plays in concentrated risk was laid bare in a discussion between Sanjay Jhamna, global head of credit trading...

FILS USA: Whither electronic bond trading?

Jenny Xiao of BlackRock and Chris Concannon of MarketAxess discuss the trends that are reshaping credit and rates markets in the Industry Crystal Ball...

FILS USA: Growing disparity in liquidity ‘haves’ and ‘have-nots’

Panellists at this year’s Fixed Income Leaders Summit agreed that industry collaboration, experimentation and greater competition are needed to improve liquidity across the fixed...

On the Desk: David Walker – Trading with your feet on the ground

David Walker, head of fixed income trading at M&G Investments, discusses no-ego trading, the importance of direct contact with markets, and strong banks relationships.

How...