Ham leads Barclays IB

Alex Ham has been named global chairman of investment banking at Barclays, effective early 2026.

In the London-based role, Ham is responsible for furthering Barclays’...

Have credit e-trading platforms just been liberated in US markets?

The removal of key legislative proposals in the US capital markets is potentially allowing electronic trading platforms to develop entirely new ways of trading...

Rosy picture for credit dealers as they lower IR risk

US dealer exposure to interest rate risk in their investment grade (IG) bond inventories hit its lowest level for twelve months in week of...

Second quarter issuance recovers after soft April and May

Morgan Stanley has reported that June issuance increased 13% year-on-year (YoY) following a 34% drop in April and 3% decline in May.

“Strong June issuance...

EM traders ride out the chaos

It would be understandable if trading in emerging markets (EM) debt were becoming more expensive as risk increased in many markets it makes up,...

Signalling risk in credit, if one counterparty is 50% volume

How do you avoid information leakage? Does this change if half the market is trading with a single counterparty? Knowing that electronic market maker,...

E-trading boosts efficiency not liquidity in Japan’s buy-and-hold bond market

Japan’s bond market has long been seen as voice-heavy, with established traditions of relationship-based trading and an aversion to electronic, less personal alternatives. However,...

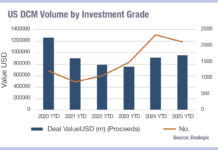

US bond deals fragment as EMEA consolidates

The latest breakdown of debt capital market (DCM) issuance by Dealogic has found that deal numbers in the US have declined slightly year-to-date versus...

Do Europe’s credit trading costs invert the pattern for US debt trades?

An analysis of average bid-ask spreads in corporate bond markets across the European and US markets suggests that median bid ask spreads responses are...

Origination: Will Germany support European debt mutualisation?

UBS Asset Management’s Jonathan Gregory, head of UK fixed income, has posited the idea that European countries may at some point seek to mutualise...