Tradeweb’s annual client letter – in full

The annual letter to clients from Tradeweb’s CEO and chair, Lee Olesky, and president and CEO-elect, Billy Hult, has been published, noting the tough...

SEC – controversially – moves to standardise best execution rules for broker-dealers

The Securities and Exchange Commission (SEC) is proposing new rules under the Securities Exchange Act of 1934 relating to a broker-dealer’s duty of best...

Cboe Australia, XTB expand access to corporate bond products

Cboe Australia has added XTB’s exchange-traded corporate bond products (XTBs) to the Cboe Funds platform.

In partnership with XTB, Cboe Australia has launched a series...

RIAs select IMTC as partner for growth in fixed income account management

IMTC, the provider of fixed income investment management technology, has signed Davenport & Company and F.L.Putnam Investment Management to use IMTC as their portfolio...

Analysis: E-trading platforms see gains and losses in corporate bond market battle

Morgan Stanley analysis of the monthly reports from market operators Tradeweb and MarketAxess, has shown wins and losses in market share for both platforms.

Looking...

CFTC proposes changes to swaps reporting

The Commodity Futures Trading Commission (CFTC) has put forward two proposals, the first to amend certain rules regarding the reporting and information regulations applicable...

Europe will need to consider market liquidity to support issuance

NextGenerationEU is the EU's €800 billion temporary recovery instrument to support the economic recovery from the coronavirus pandemic and build “a greener, more digital...

All I want for Christmas, is trading analytics

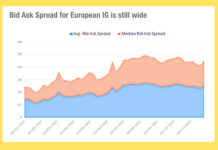

Traders would do well to run close analysis over their European trading activity this month, as data from MarketAxess Trax, which tracks trading across...

Tradeweb announces partnership with BlackRock

Multi-asset market operator, Tradeweb Markets, has entered into a multi-year partnership with BlackRock to integrate Tradeweb’s credit trading solutions and data into BlackRock’s Aladdin...

Insight Investment named collateral manager and collateral valuation agent for £1.7 billion longevity swap

Insight Investment, an investment manager with £683 billion (€778.3 billion) assets under management, has been appointed as collateral manager and collateral valuation agent for...