Competition in US Treasury clearing could sustain vicious exchange battle

The bitter competition between FMX and the CME, for trading of US Treasuries and Treasury futures, could enter an accelerated phase as new clearing...

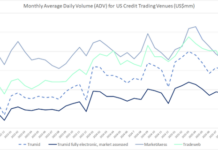

Tradeweb and MarketAxess beat TRACE growth in November

US electronic credit activity firmed in November. On FINRA’s TRACE tape, combined US investment-grade and high-yield average daily volume (ADV) rose to US$57.8 billion,...

Milei’s victory saw Argentinian debt traders reach for rapid risk transfer

In late October 2025, Argentine President Javier Milei’s party, La Libertad Avanza, scored a decisive win, in the country’s midterm elections, a political triumph...

Argentina’s battle for control

Argentina’s bond markets have been notoriously challenging for investors. Twenty years after the country underwent a major debt restructuring, and just five years after...

What Mexico’s vol risk means for trading LatAm bonds

In Latin American (LatAm) markets, economic volatility may transfer into market volatility – most notably in Mexico.

In order to manage risk and seize opportunities...

Traders welcome India’s bond e-trading evolution as regulator shows teeth

The Indian bond market provides a conundrum for investment traders, who fight to gain access to liquidity and pricing information on behalf of their...

Have credit e-trading platforms just been liberated in US markets?

The removal of key legislative proposals in the US capital markets is potentially allowing electronic trading platforms to develop entirely new ways of trading...

Do Europe’s credit trading costs invert the pattern for US debt trades?

An analysis of average bid-ask spreads in corporate bond markets across the European and US markets suggests that median bid ask spreads responses are...

Exclusive: Redefining credit markets – Neptune Networks and Liquidnet

Byron Cooper-Fogarty, CEO of Neptune Networks, and David Johnsen, head of fixed income at Liquidnet, delve into their vision for this transformative partnership.

With TP...

Exclusive: US analysis of Trading Intentions Survey 2025

This year we're diving deeper into the Trading Intentions Survey. to give a more nuanced view of buy-side engagement with trading services, platforms and...

Subscriber