Investor Demand: Apollo outlines four scenarios for investors

Torsten Sløk, Apollo Global Management’s chief economist, has outlined four key scenarios that investors need to consider potential outcomes of the current trade war...

Rosy picture for credit dealers as they lower IR risk

US dealer exposure to interest rate risk in their investment grade (IG) bond inventories hit its lowest level for twelve months in week of...

Second quarter issuance recovers after soft April and May

Morgan Stanley has reported that June issuance increased 13% year-on-year (YoY) following a 34% drop in April and 3% decline in May.

“Strong June issuance...

Insights & Analysis: Man Group quants qualify today’s economic regime

Amara Mulliner, a quant researcher at Man AHL and University of Cambridge economics graduate, and her colleagues have proposed a new way to qualify...

Managing human capital in fixed income trading

As the fixed income industry evolves, so do the skills needed to succeed — and emotional intelligence is increasingly at the forefront of how...

“There is still an edge in systematic trading”

Systematic trading is often associated with highly liquid instruments, but asset managers have outlined success stories in less liquid debt markets, at the Fixed...

Five ideas from FILS for buy-side traders

The Fixed Income Leaders’ Summit US kicked off on Monday 9 June in Washington DC, with the buy-side traders’ day. While no reporting is...

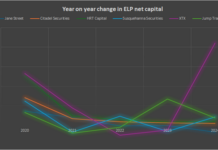

Risk profiling electronic market makers after Jane Street, Jump re-rated

Last year, Jane Street and Jump Trading had their rating outlooks upgraded by ratings agencies, as they overcame potential hurdles facing their businesses. Electronic...

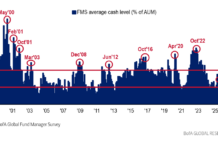

Investor Demand: BofA sees investor sentiment bounce back in May

The Bank of America Global Fund Manager Survey (FMS) has seen the scaling back of US-China tariffs as a net positive for activity. In...

Mexican bond markets: Keep your friends close

Sitting next to the US in the current trade war meant that Mexico avoided the highest bracket of US tariffs, thanks to its existing...