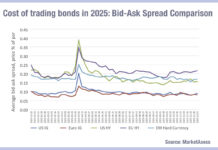

Bid-ask spread volatility highest in US bond markets

When comparing liquidity across markets in 2025, buy-side bond traders may consider European investment grade markets to have an optimal set of characteristics. However,...

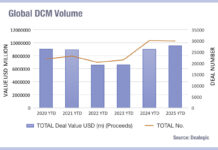

Dealogic: DCM deals in 2025 up 18% on five-year average

The preliminary view of 2025 capital markets deals, published by Dealogic, has found that global DCM volume delivered a total of US$9.5 trillion, 19%...

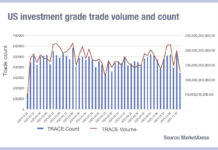

US credit activity dropped off a cliff in late November

Analysis of US corporate bond market activity has found that trading volumes and counts plummeted going into the final month of the year. A...

I just dropped in to see what condition my credit was in…

Credit conditions are in the headlines following several private credit defaults, and the debt-fuelled, forward investment in data centres which are expected to underpin...

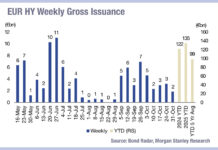

Issuance tracking down in lower rated debt

Issuance of lower rated bonds and leveraged loans across Europe and the US fell in October, according to analysis by investment bank Morgan Stanley,...

Bid-ask spreads expanding in European credit

European credit traders have seen bid-ask spreads expand over the past two weeks, however this follows a notable tightening since summer, according to data...

The de-dollarisation debate

Investors see their short duration positions getting longer this year, with a shift to EM debt, and a multi-decade case for de-dollarisation, attendees at...

FCA estimates revenue from UK consolidated tape to be £4 million over five years

Attendees at the Fixed Income Leaders Summit in Amsterdam were told to get ready for the arrival of the consolidated tape in Europe, with...

Strategically automate and allocate to survive

There is a lot to be afraid of in the modern world. Geopolitical shocks, inflation and black swans abound, and the old ways do...

Fund managers report more certainty in EM than in developed markets

The key takeaway from the first plenary session at the Fixed Income Leaders Summit in Amsterdam was clear; in 2026, uncertainty has become a...