Ratings & Analysis: AI comes for credit ratings

Credit rating agencies are facing the threat of AI, with their share prices taking a major hit this week following the release of new...

Ratings & Analysis: S&P records year’s first fallen angel

S&P Global Ratings has claimed its first fallen angel of the year. Medical device manufacturer Hologic dropped from B+ to BBB- last week, after...

UBS AM: Fixed income is starting to price better growth outcomes

By Evan Brown and Meena Bassily of UBS Asset Management

Consensus growth forecasts for the US and other advanced economies have been

repeatedly revised higher since...

Ratings & Analysis: S&P predicts a strong 2026 for EM EMEA insurers

Insurance markets in emerging EMEA markets will remain strong in 2026, according to S&P Global Ratings predictions.

The creditworthiness of insurers in these markets, consisting...

Ratings & Analysis: S&P Global taps Snowflake connectivity for private markets investors

Private markets investors are now able to input data from S&P Global’s iLEVEL portfolio monitoring platform directly into their Snowflake environments.

Investors will be able...

Ratings & Analysis: S&P upgrades South Africa

S&P Global Ratings has upgraded South Africa’s long-term sovereign ratings, assigning the country BB for foreign currency and BB+ for local currency, with a...

Ratings and Analysis: Is the life insurance the wobbly leg of finance?

US life insurer, Brighthouse Financial, was downgraded by ratings agency Fitch on Monday, following the announcement it was to be acquired by private investment...

Ratings & Analysis: Fitch: US bank regulators converging with “informal alignments”

Executive actions have accelerated regulatory consolidation and centralisation between federal US bank regulators, according to Fitch Ratings.

These informal alignments, driven by executive orders rather...

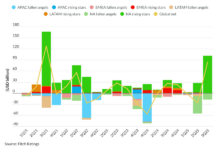

Ratings & Analysis: Fitch’s rising stars accelerate upgraded debt levels

Changing credit ratings for three North American issuers in Q3 2025 pushed upgraded debt levels above downgraded debt in its global corporate portfolio, Fitch...

Ratings & Analysis: Vietnam and Greece reclassified in FTSE Russell review

Vietnam and Greece have been upgraded in FTSE Russell’s semi-annual country classification review for its equities and fixed income indices. Changes will be effective...