Cross-asset TCA is viable in credit markets

Can transaction cost analysis (TCA) provide an apples-for-apples comparison of buy-side trading costs across different asset classes? Imposing a single measurement framework across markets...

Bid-ask spread volatility highest in US bond markets

When comparing liquidity across markets in 2025, buy-side bond traders may consider European investment grade markets to have an optimal set of characteristics. However,...

US credit activity dropped off a cliff in late November

Analysis of US corporate bond market activity has found that trading volumes and counts plummeted going into the final month of the year. A...

Credit trades’ double-figure yearly growth proves liquidity dividend

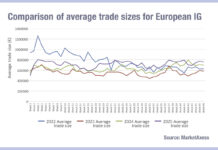

The gradual growth in trade sizes for European corporate bond trades is made clear in the latest MarketAxess TraX data comparison for data from...

Milei’s victory saw Argentinian debt traders reach for rapid risk transfer

In late October 2025, Argentine President Javier Milei’s party, La Libertad Avanza, scored a decisive win, in the country’s midterm elections, a political triumph...

Bid-ask spreads expanding in European credit

European credit traders have seen bid-ask spreads expand over the past two weeks, however this follows a notable tightening since summer, according to data...

Why humans give the best execution

Understanding best execution requires an understanding that both explicit and implicit costs can have a serious impact on investment goals, and these often reach...

Bond traders predict data science/AI use explosion in 2026

The DESK’s Corporate Bond Liquidity Access Survey, supported by LTX, finds trading desks are on the cusp of change.

Buy-side traders see 2026 as a turning...

Subscriber

Complex environment requires multi-model approach to data science

In fixed income, the most effective investment and trading models can be those built to withstand uncertainty. Speaking at the Fixed Income Leaders’ Summit...

“There is still an edge in systematic trading”

Systematic trading is often associated with highly liquid instruments, but asset managers have outlined success stories in less liquid debt markets, at the Fixed...