Crunch on liquidity costs

As bid-ask spreads begin to widen on both sides of the Atlantic, buy-side credit traders need to reassess how to best manage the crunch...

Orderly sell-off despite Bund bid-ask spread blow out

Borrowing costs for the German government spiked after an announcement of increased expenditure for its military, triggering a sell-off in German government bonds (bunds)...

Can TCA work for voice/chat credit trades?

Transaction cost analysis (TCA) – or execution quality analytics (EQA) – is a much sought after, but often objectively challenged, service in corporate bond...

Squeezing the bid-ask spread

Bid-ask spreads in the corporate bond space have continued to collapse in 2025, suggesting that liquidity costs are dramatically improving for buy-side traders.

Looking at...

Meet the consolidated tape contenders

Europe’s development of a consolidated tape for trading data now has clear front runners, and benefits.

Three firms have confirmed they will compete to be...

Equity venues are dating websites; credit venues are bars

Equity venues are dating apps – you have to be a member to use the central limit order book (CLOB), and it will match...

What is behind the falling cost of IG liquidity?

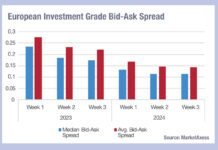

The bid-ask spreads in credit trading across the Europe and US have fallen dramatically in the first three weeks of 2024, relative to the...

Finbourne responds to closure of Bloomberg, MarketAxess & Tradeweb consolidated tape project

Finbourne, the financial technology and services firm selected to manage the now defunct joint project between Bloomberg, MarketAxess and Tradeweb to launch a consolidated...

Oliver Haste joins Propellant.digital

Bond market analytics provider, Propellant.digital, has announced that Oliver Haste has joined as head of EMEA product, Propellant’s second senior appointment in five weeks,...

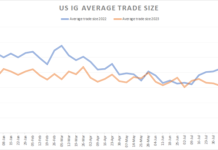

Are average trade sizes really falling in the US?

Earlier this year we noted that average trade sizes were down considerably on 2022, but being wary of mean reversion, we wanted to revisit...