J.P. Morgan Execute powers the future of e-trading

Close teamwork is seamlessly delivering sophisticated services to the users of J.P. Morgan’s Execute platform.

J.P. Morgan’s Execute platform has 4,000 users globally, and facilitates...

Are bigger trades always better?

Average trade sizes appear to have been increasing in corporate bond markets in recent years. Superficially this might suggest a greater dealer capacity to...

Why humans give the best execution

Understanding best execution requires an understanding that both explicit and implicit costs can have a serious impact on investment goals, and these often reach...

Aligning the pre-trade credit liquidity picture and the execution goal

Pre-trade data and market colour are imperative for buy-side traders looking to achieve best execution in corporate bond markets. Understanding how that applies to...

“A fixed income price is not a fact. A fixed income price is an...

David LaRusso is the head of fixed income trading at Dimensional Fund Advisors, and has just celebrated his 25th anniversary at the firm. The...

EM traders ride out the chaos

It would be understandable if trading in emerging markets (EM) debt were becoming more expensive as risk increased in many markets it makes up,...

Electronification of US credit delivers resilience

The electronification of the US corporate bond markets has demonstrated that its improved efficiency has strengthened depth of liquidity provision, rather than made it...

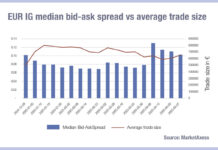

European bid-ask credit spreads not assuaged by tariff roll back

Liquidity costs in European corporate bond trading remain elevated, after the tariff shock in early April saw bid-ask spreads widen significantly across markets, according...

Excited or scared? The liquidity rollercoaster

Bid-ask spreads across all credit markets shot up in the week of 7 April, following the announcement of global tariffs on imports to the...

Squeezing the bid-ask spread

Bid-ask spreads in the corporate bond space have continued to collapse in 2025, suggesting that liquidity costs are dramatically improving for buy-side traders.

Looking at...