Milei’s victory saw Argentinian debt traders reach for rapid risk transfer

In late October 2025, Argentine President Javier Milei’s party, La Libertad Avanza, scored a decisive win, in the country’s midterm elections, a political triumph...

I just dropped in to see what condition my credit was in…

Credit conditions are in the headlines following several private credit defaults, and the debt-fuelled, forward investment in data centres which are expected to underpin...

Secular vs cyclical: How e-trading, issuance and credit spreads align with liquidity

Primary markets are a crucial source of liquidity in secondary markets, as new issues trigger a round of buying and selling activity for newly...

Analysing concern around Japan’s government bond issuance and interdealer inefficiency

The appointment of Liberal Democratic Party (LDP) leader Sanae Takaichi as the country’s first female prime minister has drawn comparisons with two of the...

Quant funds assess the value of trading

There are huge variations in investment and trading activity across quantitative strategies, the Fixed Income Leaders Summit heard in Amsterdam on Wednesday, and the...

Investor Demand: IG private credit creates ‘attractive entry points’ for investors

Research by Aviva Investors has broken down the illiquidity premia paid via private debt markets, noting that it is improving for investors, even as...

TradFi meets DeFi: Integrating FIX and distributed ledgers

Led by global co-chair Digital Assets & Technology Committee, Vince Turcotte, 35 participants from the APAC digital assets ecosystem gathered at the 23rd Asia...

Rules & Ratings: S&P warns on forecast uncertainty

S&P Global Ratings has said it believes a high degree of unpredictability exists around policy implementation by the US administration and possible responses regarding...

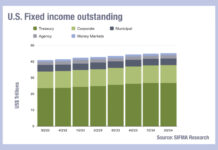

Money markets begin to tail off as rates fall

Reviewing the second quarter activity in primary markets and fund flows, we see the total notional outstanding in US fixed income totalled US$45.3 trillion,...

The pros and cons of record issuance

Bond markets typically see increased liquidity around a bond shortly after it is issued. However, this does not mean that markets are automatically more...