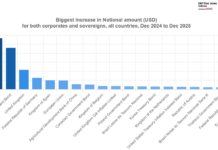

The European Union saw the biggest increase in bond issuance globally in March, reaching US$30.62 billion.

The bulk of this came from three bond issuances by the European Commission over the month totalled €13.7 billion, alongside a further six bill issuances, totalling €7.5 billion.

EU bond issuance remained steady in April, with five issuances amounting to €13 billion taking place over the month. Three of the five were issued at auctions, the remainder as syndicated transactions.

This accounts for 14% of the €90 billion in long-term EU bonds the union plans to issue over H1 2025. These will be issued across seven bond auctions and six syndicated transactions, according to its latest funding plan.

Funds raised will be allocated to policy programme payments including Ukraine support, Western Balkans reform and growth and macro financial assistance initiatives. They will also go towards NextGenerationEU payments, a region-wide economic growth project.

Earlier this month, Eurex announced that it would offer EU bond futures from September 2025 as EU debt issuance increased.

READ MORE: Eurex launches EU bond futures

In May, EU bond auctions will take place on 19 Monday and syndicated transactions from 12 Monday to 16 Friday.

©Markets Media Europe 2025