By Davide Masi, Global Product Lead, Credit Derivatives and Leon Von Essen, Product Manager, Credit Derivatives at Eurex

Futurization is the next step in the electronification of corporate bond trading

The global derivatives landscape is undergoing a significant transformation, particularly in credit markets, which have historically lagged equities in terms of electronification. Advances in electronic trading and the ability to bundle risk via ETFs and portfolio trading have paved the way for increased transparency and efficiency. Now, progress made in the “futurization” of this market is further reshaping how institutions manage risk and access liquidity.

“Futurization” refers to the migration of traditionally OTC-traded instruments into standardized, exchange-traded and centrally cleared contracts. This trend is most evident in the rapid development of credit index futures, which are emerging as a credible alternative to OTC-traded credit derivatives, such as credit default swap indices (CDXs) and total return swaps (TRSs). These futures offer a more accessible, transparent, and capital-efficient way to gain or hedge credit exposure to broad fixed income benchmark indices.

Eurex has been a pioneer in this segment, launching a global suite of credit index futures that track major fixed income benchmarks, including Euro and US dollar-denominated investment grade and high yield indexes, as well as emerging market sovereign debt. These products are designed to mirror the exposure offered by TRS in a liquid, easily accessible and fungible format. Futures users always face the clearing house as a central counterparty (CCP) and open positions can be offset against any other market participant, not only the original counterparty.

Trading Credit indices – as easy as can be

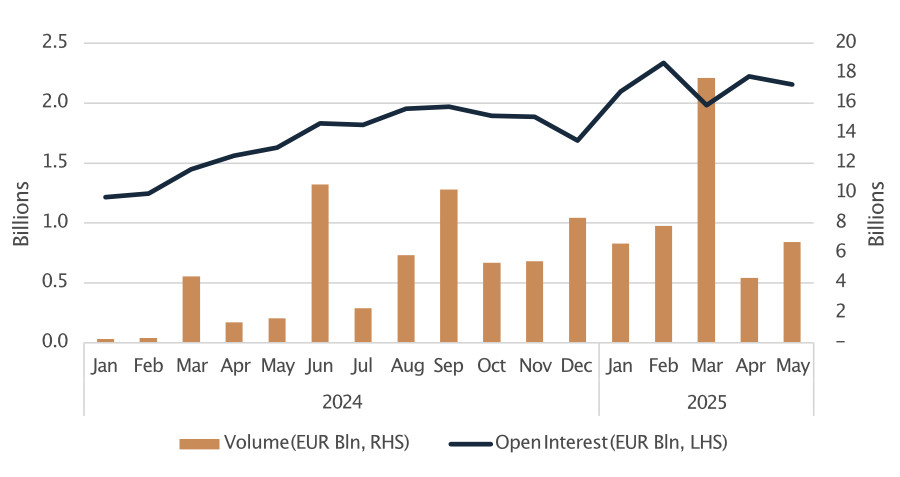

The adoption of Credit Index Futures has been swift, particularly among buy-side firms. Large asset managers have started to use these products for their efficiency in hedging and portfolio construction, while smaller firms, previously unable to access OTC markets, now have a viable alternative to take synthetic exposure to global credit benchmarks. Trading volumes in euro-denominated investment grade and high yield futures have grown rapidly, with the ecosystem now capable of handling trade sizes of a similar scale to ETF markets.

One of the key drivers of this adoption is the operational simplicity and flexibility of credit index futures. They are cash-settled, easily integrated into existing trading systems, and compatible with a wide range of strategies. End-users have successfully utilized the products to hedge against market volatility, manage liquidity during stress events, and quickly build beta exposure when launching new funds.

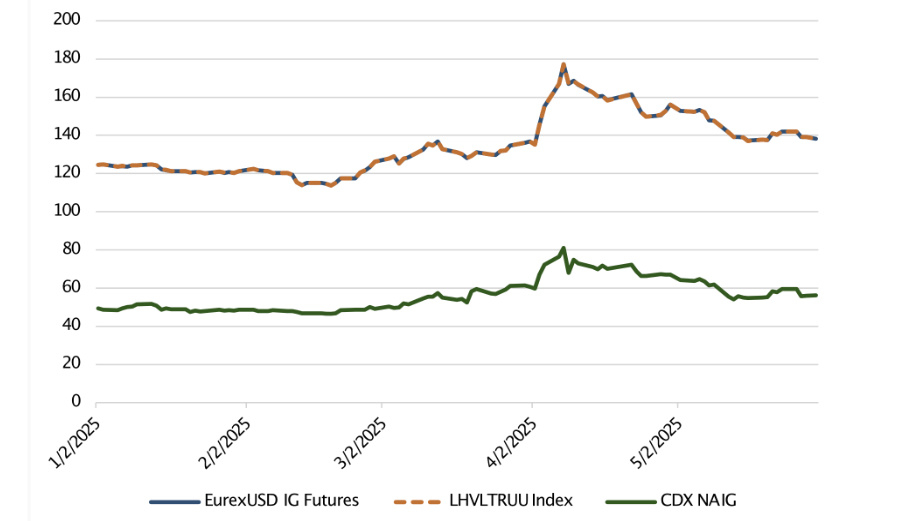

Moreover, these futures are increasingly used in conjunction with OTC instruments, enabling sophisticated strategies such as basis trading. Investors can exploit pricing differences between futures and CDS indices or between futures-implied funding rates and actual funding costs.

From an execution perspective, Eurex supports multiple protocols, including electronic order books, RFQ platforms, and voice trading, which has helped facilitate further adoption. This flexibility ensures that participants can access liquidity through the most effective channels, whether on- or off-exchange. This hybrid approach to execution allows firms to access deep liquidity pools while benefiting from the capital and workflow efficiencies of listed products.

Figure 1: Notional volume and Open Interest (EUR Bn) for Eurex-traded Credit Index Futures. Source: Eurex

Eurex Credit Index Futures – The right tool at the right time

Credit as an asset class is particularly interesting thanks to its risk components, which enhance risk-adjusted returns. Both interest rates and credit risk premia contribute to the returns of this asset class and have historically offset each other during times of distress.

Global interest in and exposure to credit markets have risen in recent years. The re-emergence of interest rate volatility in Europe and the US, combined with attractive yield levels, has made the asset class more appealing. With renewed interest in credit, market participants have been looking at traditional and new instruments to express their views.

Eurex Credit index futures are exceptionally well-suited for allocations to the credit market. The instruments provide unfunded exposure to the underlying corporate bond index returns, allowing participants to quickly manage exposure to these markets without requiring large cash outlays.

Figure 2: Option adjusted Spreads (vs. Swap Curve) of Eurex Traded $IG Credit Index Futures, underlying $IG Index and the Corresponding on-the-run 5yr CDX. Source: Bloomberg LP, Eurex

Navigating market turmoil – Eurex Credit Index Futures provide a tailored benchmark hedge

Credit index futures have proven to be excellent tools for hedging corporate bond portfolios and minimizing tracking errors. The underlying benchmark indices track the total return of a broadly diversified portfolio of corporate bonds. The main risk factors affecting fixed income portfolios, such as credit spread risk and duration, can be managed simultaneously via these products. As a result, the basis between Credit Index Futures and corporate bond portfolios is minimized. Furthermore, the broad diversification of the underlying indexes ensures that idiosyncratic risks are minimized thanks to the high number of distinct issuers represented.

Eurex Credit Index Futures are the most efficient tool for shorting the corporate bond market. Unlike cash bond markets, where securities must be borrowed before short-selling, Eurex Credit Index Futures market participants can open a short position by simply selling the futures. Since futures contract prices are bound to the law of no-arbitrage, the costs related to short-selling the underlying corporate bond index are all accounted for in the traded price of Eurex Credit Index Futures.

Figure 3: Pure and hedged Position in EUR HY using Eurex Credit Index Futures. Contracts are rolled two days before expiry. 1 Jan 2025 = 100. Source: Bloomberg LP, Eurex

The Future of Credit Markets

Eurex’s vision for credit index futures is to accelerate the electronification, standardization, and integration of credit markets. Eurex Credit Index Futures are set to expand their presence in the markets, attracting not only traditional users of credit products but also systematic trading firms and CTAs that have historically been unable to access this ecosystem.

Eurex’s pipeline includes new features for its Credit Index Futures. The exchange aims to broaden its client distribution, supported by sell-side partners and third-party electronic trading platforms. Leveraging its global and multi-asset product suite, Eurex can capitalize on cross-product efficiencies, such as risk-offsetting Credit Index Futures with its Fixed Income product suite at the CCP level. New product launches are also on the horizon, as the exchange takes a leading role in the futurization of global credit markets.

©Markets Media Europe 2025