Bond markets are beginning to settle on both sides of the Atlantic after the shock of Liberation Day and various amendments to tariff policies that took place at the end of April. But while the US gets back on its feet, Europe is making a more hesitant recovery.

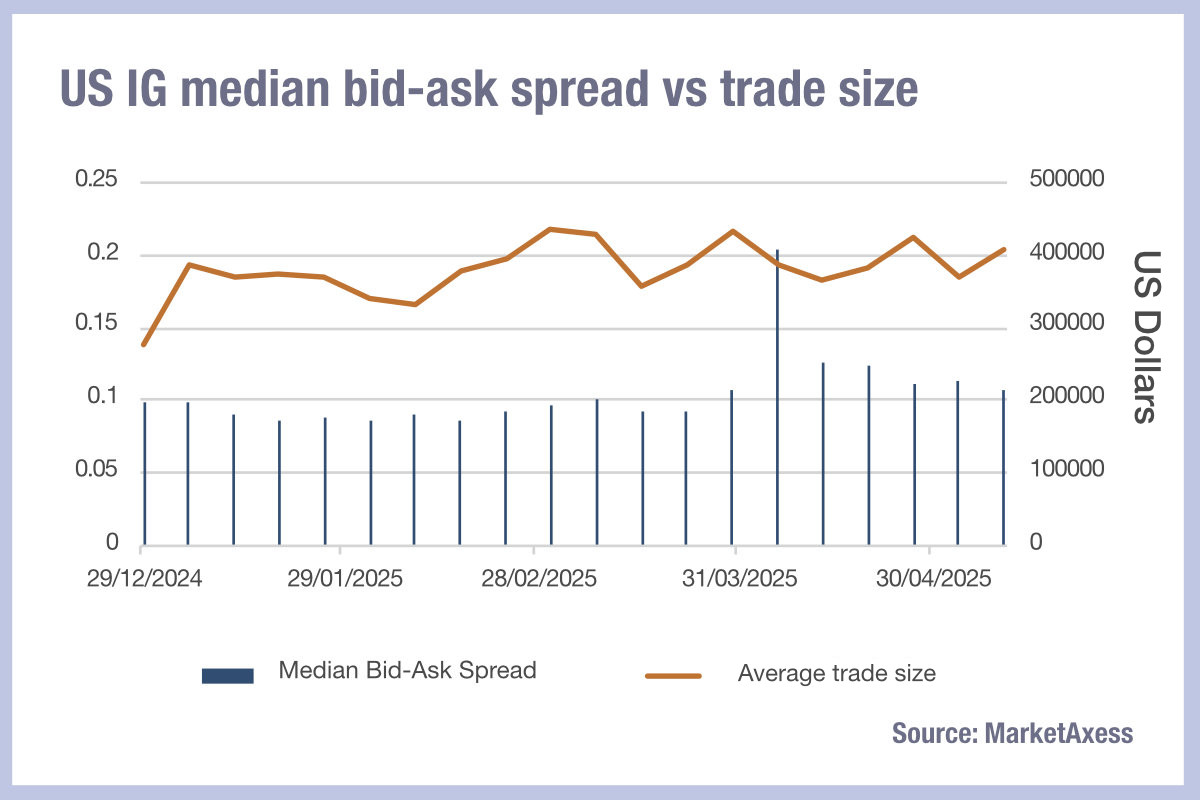

The reducing cost of liquidity seen in the US post-Liberation Day has continued, according to MarketAxess data. Average trade sizes ticked up in the second week of May in both asset classes, and while the median bid-ask spread rose in HY, after four consecutive weeks of decline, IG hit its lowest spreads narrowly missed returning to pre-Liberation day lows.

The reducing cost of liquidity seen in the US post-Liberation Day has continued, according to MarketAxess data. Average trade sizes ticked up in the second week of May in both asset classes, and while the median bid-ask spread rose in HY, after four consecutive weeks of decline, IG hit its lowest spreads narrowly missed returning to pre-Liberation day lows.

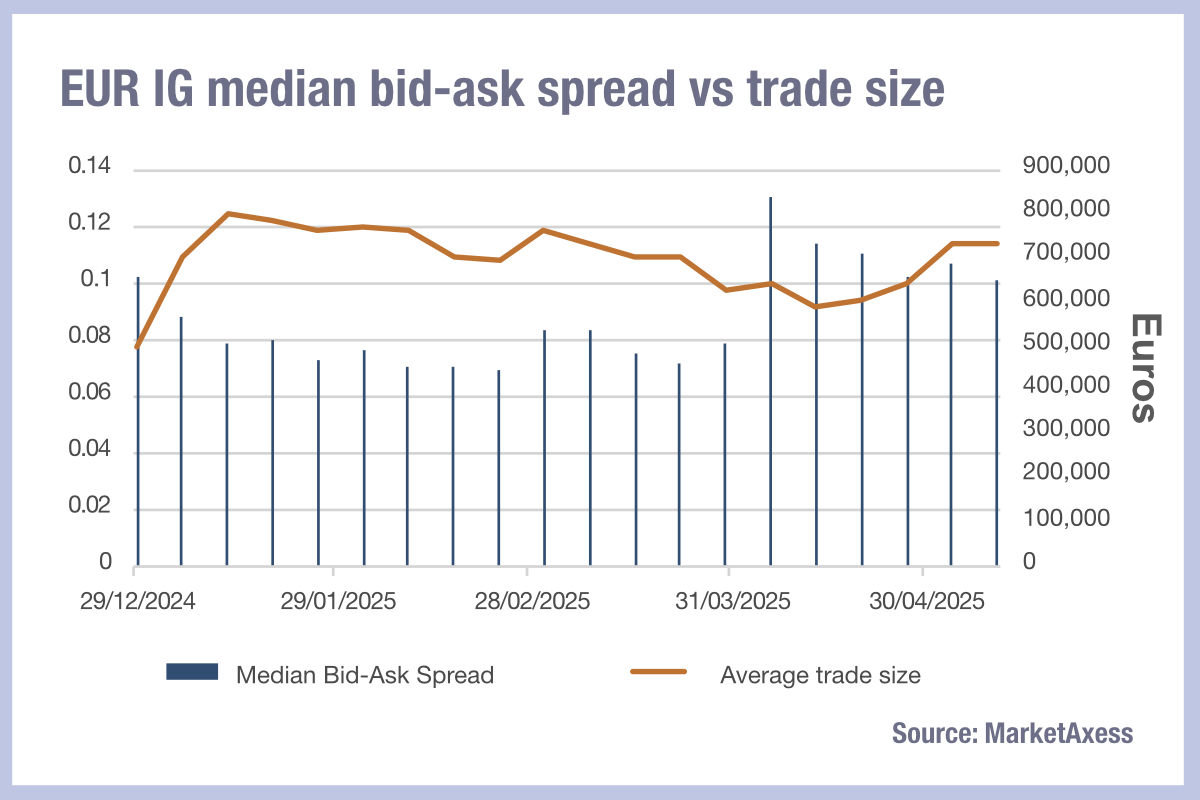

With a more tentative recovery, European IG is now joining in on the trend. While still more elevated than its American counterpart, bid-ask spreads have begun to move in tandem with average trade sizes once again. The asset class saw the greatest increase in liquidity costs at the start of April, and the median bid-ask spread is still well above pre-April levels. This suggests that European parties are considering the market and associated risks by different metrics – or are less confident in credit conditions.

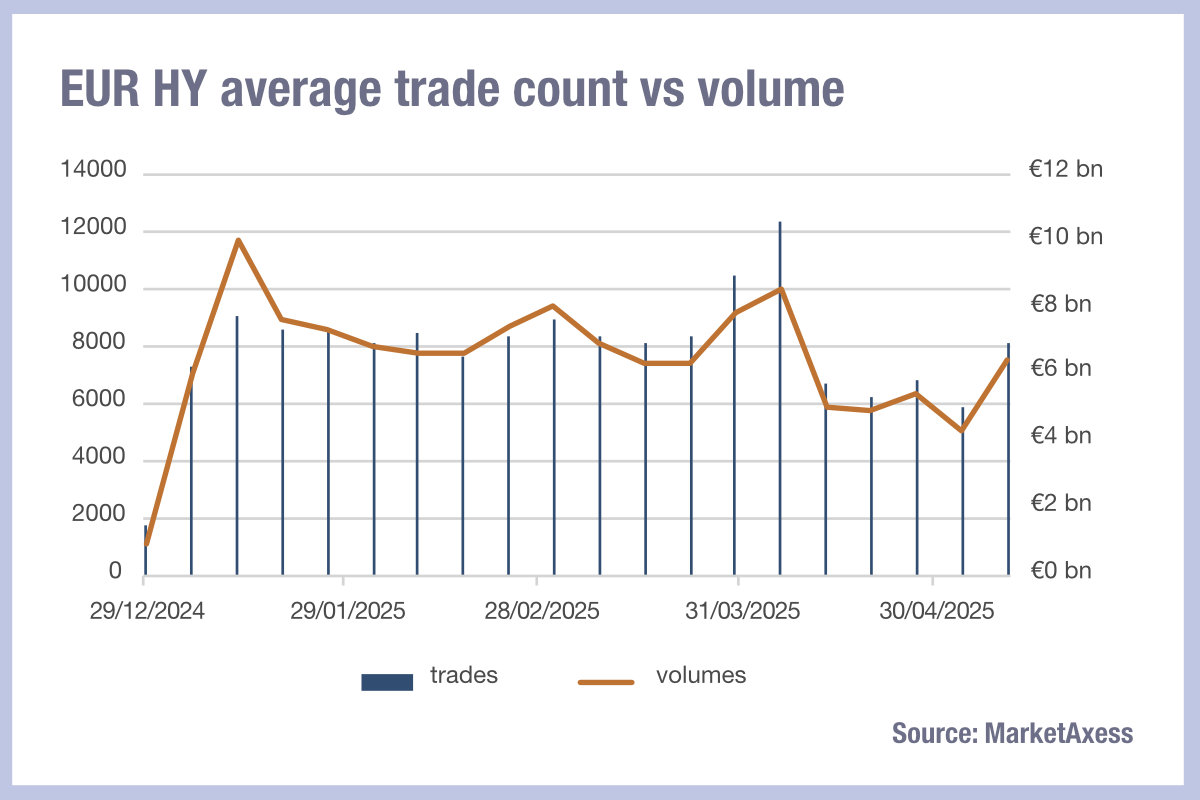

In HY bid-ask spreads are continuing to move with average trade sizes, continuing a slow but steady de-escalation.

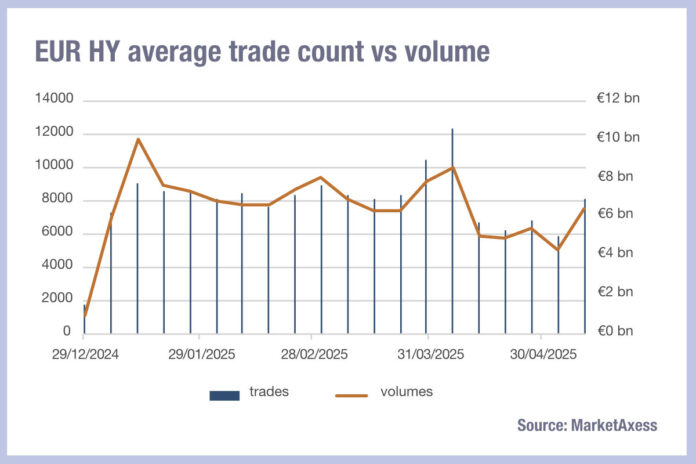

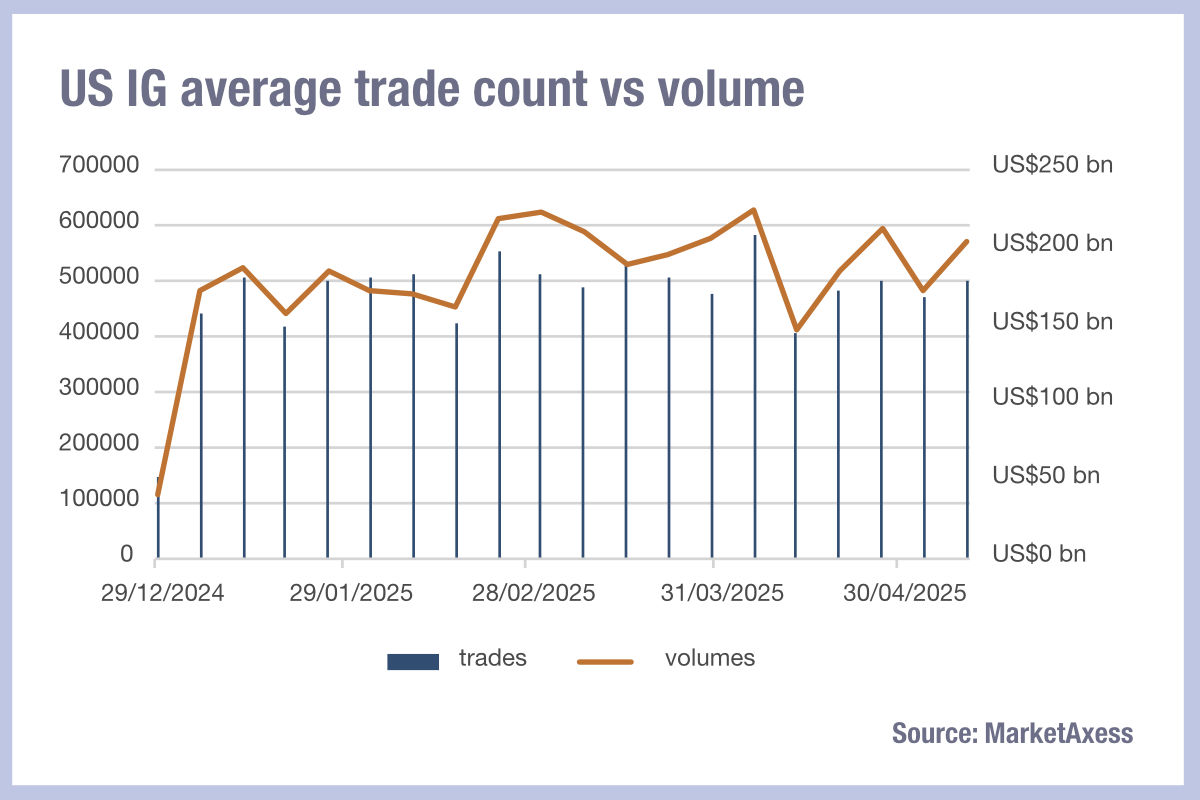

Investors appear to be making smaller trades rather than taking big swings in both European IG and HY, with the number of tickets slightly outpacing volumes. In US IG, by contrast, block trading seems to be taking the lead – continuing a trend that the asset class has followed since February.

Trading volumes, which fell sharply in the second week of April, have begun to return to levels seen over the last five months – perhaps as investors change positions to keep up with rapid policy changes by the Trump government and dealers become more comfortable taking risks.

While the reverberations of April’s event are still being felt across the markets, their severity is far reduced. As some of Trump’s harsher tariffs were pared back, some traders may be less likely to base their decisions on the President’s policy decisions.

©Markets Media Europe 2025