In a recent research note Zornitsa Todorova, head of FICC research at Barclays contends that with over half of IG volumes now electronic, systematic desks are reshaping when and how credit trades get done, Fridays and even lunch time are now open for trading.

The analyst in its note, “Goodbye, Seasonality,” says: “Credit trading is shaking off seasonal lulls. Volumes over holiday months, Fridays and even lunch hours are now matching typical levels. As human traders step back, algos and portfolio trades step in.”

About the shift in regime, the bank says: “August and December, once the quietest months, now each account for nearly 8% of annual volumes, up from 6–7% pre-2022.”

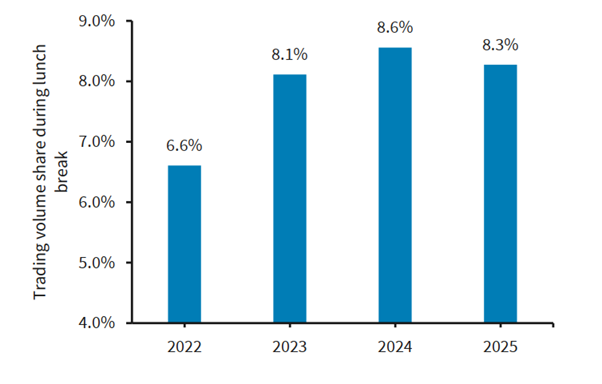

Furthermore, Todorova says that “Friday volumes have caught up with mid-week levels. And even lunch hours are getting louder – trading over 12–1pm is up from 11.3% to 12.5% in US IG and from 6.6% to 8.3% in EUR IG since 2022.”

Rising automation is at the centre of the change. With electronic trading now representing more than 50% of US and EU investment grade (IG) volumes, Todorova points out that this share of activity is up 5 to ten percentage points during holidays or lunch time. Systematic trading steps in when voice traders step off the desks.

Rather than calling all seasonality patterns finished, the analyst expects smaller liquidity patterns swings.

She says: “Some seasonality will stick given the primary issuance calendar, but algos are closing the gap.”

©Markets Media Europe 2025