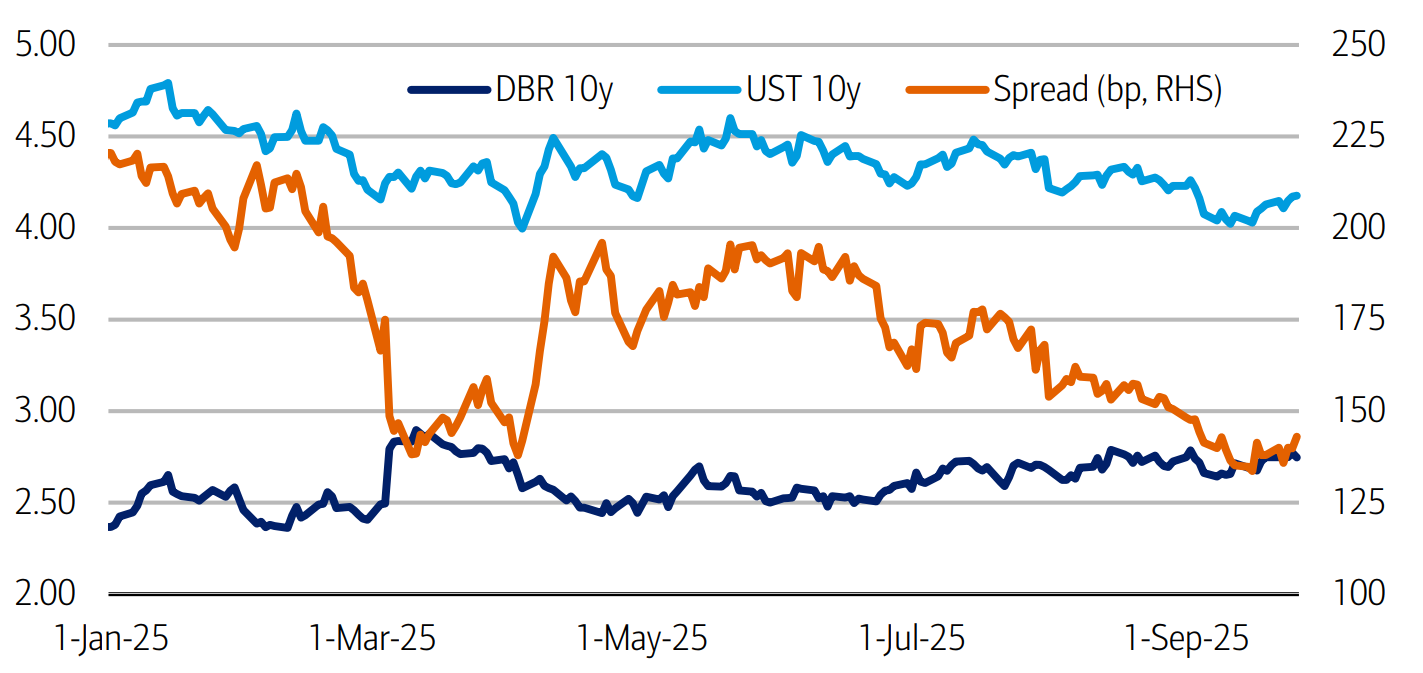

Market pricing since 21 May reads as if investors prefer US duration over euro-area duration: 10-year US Treasuries (UST) have rallied by 42 basis points (bps) while 10-year Bunds have sold off by 10bps, tightening the Bund versus US ten-year notes spread by 52bps.

In his 1 October note, BofA Global Research’s Ralf Preusser said: “It is not the Fed that has richened USTs but the ECB that has cheapened Bunds.”

BofA rules out the usual drivers. US and euro-area 10-year inflation swaps both rose by about 4bps over the period, and asset-swap spreads richened by 6bps versus secured overnight financing rates (SOFR) for USTs and 1.5bps versus Euribor for Bunds. According to BofA this is insufficient to explain Germany’s lag. Preusser also rules out term premium reasons as the EUR denominated term premium – how much investors are rewarded for holding longer dated bonds, term premium – noting that Europeans’ term premium has richened more than USD’s since late May.

Instead, according to BofA, it is front-end policy expectation that has driven the divergence. Since 21 May, the market has added only 9bps of cuts to US 1- year forward rates to 2-years bonds (1y1y), but repriced EUR 1y1y by 48bps relative to the ECB’s deposit rate.

BofA says: “EUR 1y1y has gone from pricing in one cut to pricing in almost one hike.”

This leads BofA to suggest there might be a value proposition in euro rates for investors sensitive to tightening financial conditions in the EU.

©Markets Media Europe 2025