Real-money buyers have started to bid the long end of the Treasury curve as systematic funds keep up their selling, leaving the long end looking both cheap and yet prone to further sell offs, bank research shows.

After months in which an ever-increasing outlook for supply kept buyers on the sidelines, evidence is emerging that traditional investors are returning to the long end of the US Treasury market.

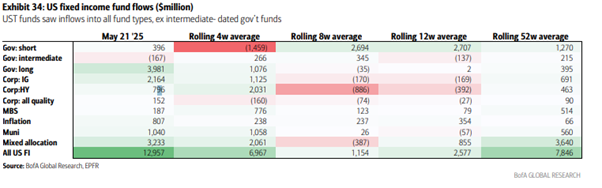

“Last week we began to see some long-end inflows manifest, suggesting that valuations may be getting to a place where investors feel comfortable buying,” wrote Meghan Swiber and Katie Craig, rates strategists at BofA Securities in their 26 May US Rates Watch note.

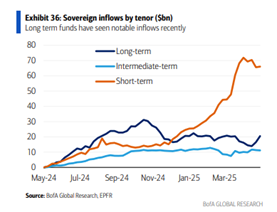

The BofA team points to fund-flow data, stating: “[US fixed income funds] saw outsized inflows dominated by long-end sovereign, mixed-allocation and investment-grade funds. Long-end inflows have been relatively muted versus the front end of the curve over the past year and the recent uptick may reflect that yields have cheapened enough to lure demand.”

They also highlight that primary-dealer holdings of long-dated cash Treasuries “declined meaningfully” in the week to 14 May, evidence that new supply is being absorbed more readily.

Foreign demand is improving at the margin. According to BofA, 10- and 30-year auctions earlier this month drew foreign allotments of 19% and 12%respectively, noting “a modest improvement from historically low levels”.

That said, the custody data tells a more cautious story: foreign official institutions have shed nearly US$40 billion of Treasuries since the end of April, BofA stated, even as private overseas investors have been selective buyers.

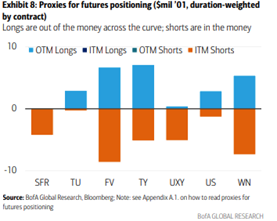

Set against the tentative real-money bid is mechanical selling by commodity-trading advisers (CTAs). In a 27 May CTA Positioning and Flows update, UBS strategists led by Nicolas Le Roux observed: “CTAs are selling duration fast and in size. In just the last two weeks they sold US$70-80 million worth of DV01 [dollar value of a basis point]. Flows should moderate going forward, but declining bond volatilities — especially in Europe, leading to increased leverage — should keep some of the selling pressures alive.”

UBS’s model now shows CTAs net short roughly US$11 million DV01 in 30-year futures and extending those shorts across the curve, with expected flows over the next fortnight still skewed towards additional selling.

If real-money demand continues to build, the cheapening process may be nearing an end. But, as Swiber and Craig caution, CTAs still have room to exacerbate sell-offs if downwards momentum started again.

©Markets Media Europe 2025