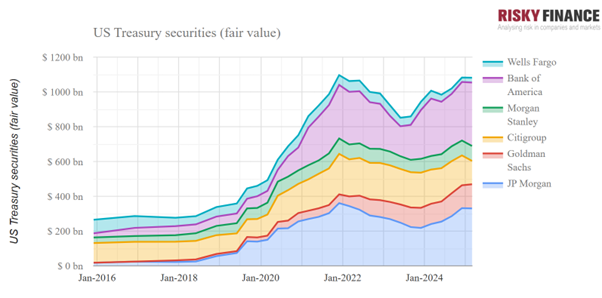

Easier 2025 stress test assumptions and friendlier accumulated other comprehensive income (AOCI) treatment have freed capital for American investment banks’ fixed income desks; US treasuries inventories at American banks had jumped back to record highs going into it.

As US banks prepare to release their second-quarter earnings, results from the Federal Reserve’s annual stress tests, on 27 June, means free to be deployed additional risk capital at major US banks.

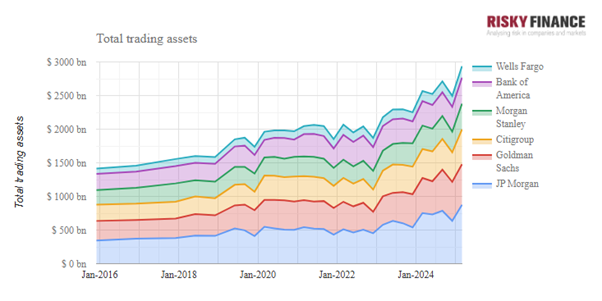

Tallies, provided by Risky Finance, of trading asset trends across major US banks, including JP Morgan, Goldman Sachs, Morgan Stanley, Citigroup, Wells Fargo and Bank of America, show total trading assets on US banks’ books have been accelerating upward. This increase was already pronounced from the end of 2024 into 2025 with the arrival of the new US administration; JP Morgan total trading assets grew from US$637 billion at the end of 2024 to US$873 billion at the end of Q1 2025, and from US$579 billion to US$604 billion for Goldman Sachs.

Goldman Sachs was the clearest victor of this year’s Fed’s less stressed scenario, with projected trading losses shrinking to just US$300 million under its downturn assumptions, compared to US$18 billion in the previous year. The bank benefited from tighter internal risk controls and methodological easing in the Fed’s stress testing, such as the removal of private equity investments from its market shock scenario.

The 2025 stress-test models were more lenient on their treatment of AOCI: For the first time, the Federal Reserve recognised offsetting positions. “The Fed better incorporated hedges that could impact AOCI and also incorporated synthetic risk transfers that could reduce a bank’s credit exposure via derivatives,” wrote Mike Mayo, Well Fargo’s famous analyst. By acknowledging those hedges, the Fed trimmed the hit to common equity tier 1 (CET1) ratios from rising rates, effectively lowering stressed capital buffers and freeing capacity for fresh fixed-income risk.

Mayo called the 2025 run “the least stressful this decade,” noting smaller market shocks, better hedge recognition and – crucial for bond portfolios – “less impact from AOCI” after the Fed refined its hedge accounting treatment. Those tweaks took 60 basis points(bp) off the median stress capital buffer (SCB) and, by Mayo’s count, freed about US$50 bn of CET1 capital that can be redeployed into trading books or buybacks.

Morgan Stanley analyst, Betsy Graseck, believes that loosened hand is already showing up in the quarter just ended: “We expect FICC Markets revenues up +6% year-over-year, driven by robust client activity in rates and credit,” wrote analyst Betsy Graseck in the firm’s 2Q25 preview. The team sees banks with large financing operations, notably Goldman Sachs and JP Morgan, capturing a disproportionate share of that volume.

For Goldman, the relief is particularly potent. Its SCB went down by 140 bp on the Fed’s proposed two-year averaging method, unlocking an estimated US$9.4 billion of excess capital. JP Morgan follows closely with 50 bp SCB relief and US$9.2 billion of new headroom in its CET1 Management commentary, this quarter, is therefore likely to focus on what they will use this freed capital for.

©Markets Media Europe 2025